By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

What Is a Durable Power of Attorney?

A durable power of attorney is the delegation of certain financial powers from one (1) party to another. In other words, the authority delivered enables the agent to function as the principal in regard to the assigned duties. All the filing party has to do is indicate what they would like the attorney-in-fact to handle and sign off on the form while under the review of a notarial official and/or witnessing parties (depending on the state laws).

This form only terminates if the principal cancels the terms (with a revocation), creates a new durable power of attorney, or perishes at any time. The document can cover an array of different areas related to the principal’s finances and overall assets, such as:

- Banking

- Safe Deposit Boxes

- Lending or Borrowing

- Government Benefits

- Retirement Plans

- Taxes

- Insurance

- Real Estate

- Personal Property

- Property Management

- Gifts

- Legal Advice and Proceedings

How to Get Durable Power of Attorney

Those who seek to carry out a durable power of attorney without the assistance of a legal professional may do so by following the steps below.

Step 1 – Acquire a Form

The first course of action requires you to obtain a copy of the document. It is important that you choose a form that meets the criteria of your jurisdiction. This page contains a generic version of the DPOA that is accepted by most states, but there is also a state-by-state section that allows users to select their own region of the country for more specific forms.

Review the document thoroughly to ensure that it contains all the necessary components you need to achieve a sound principal-agent relationship.

Step 2 – Choose an Agent

Since you have decided to start the process of assigning durable power of attorney, it is fair to assume that you have an agent in mind. Executors should make sure that the individual they are granting the power to has their best interest at heart, e.g, a spouse, relative, or close associate.

Once you have determined who your attorney-in-fact will be, you should consult with them to confirm that they are willing to accept the role.

Step 3 – Fill Out the Document

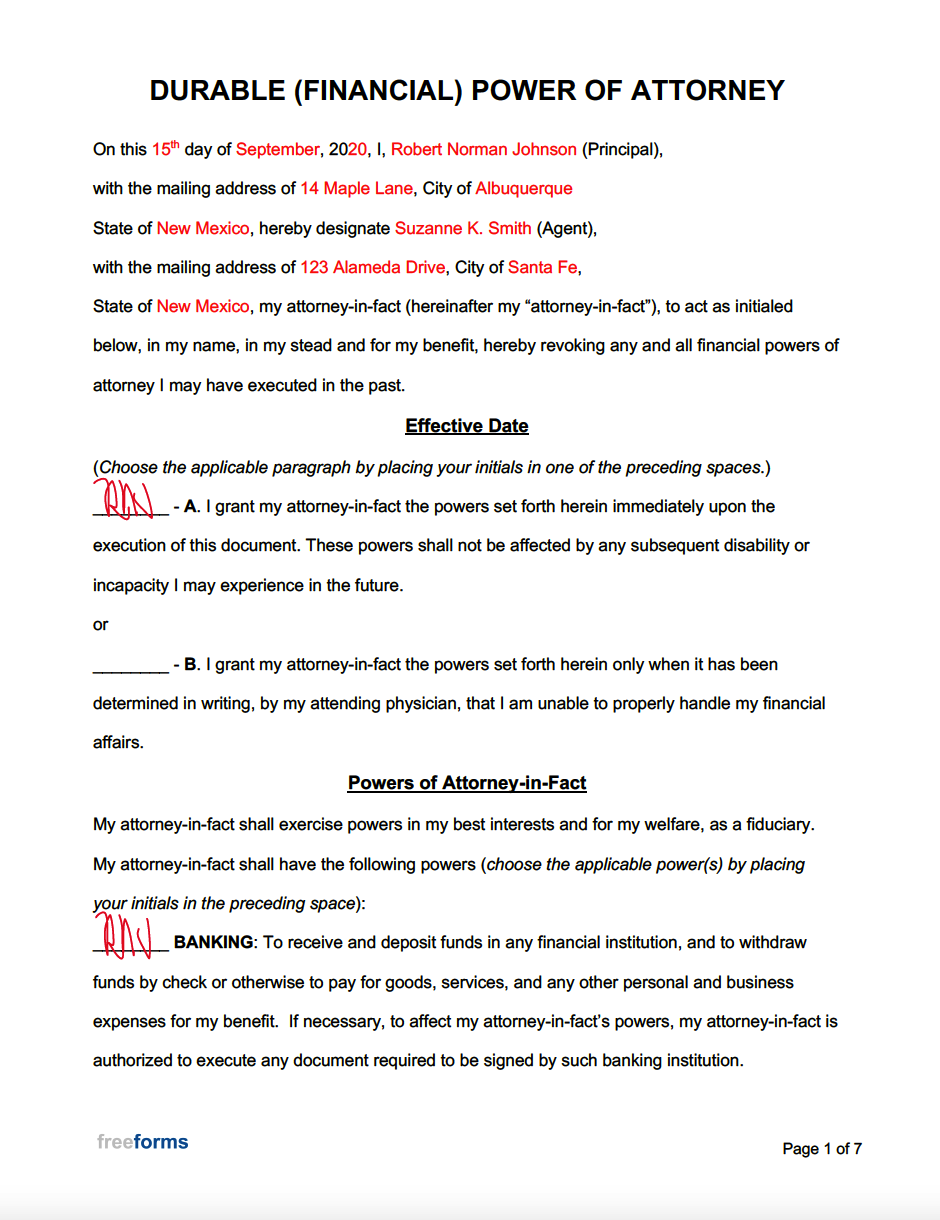

Now that you have the form and established who your representative will be, it’s time to customize the document to fit your needs and record the necessary details. The following information will need to be registered within the form:

- Identities of Both Parties – The names and addresses of the principal and agent.

- Effective Date – Will the powers be granted immediately, or only once the principal has become incapacitated?

- Authority – Which financial powers will be granted to the agent?

- Special Instructions – If desired, the principal may extend or limit the agent’s scope of authority by writing in any additional provisions they deem necessary.

Step 4 – Sign Accordingly

After making your selections and filling in each required field, it will be time to finalize the terms of the document by signing it. The requirements of this step can vary from state to state. That being said, most states demand that both parties sign the instrument in the presence of a notary public and/or two (2) witnesses.

After this obligation has been met, the document will become legally binding and the agent will be able to act on the principal’s behalf immediately or once they have become incapacitated.

Step 5 – Provide Copies

Congratulations! You now have an active DPOA that will remain in effect indefinitely, unless it is later revoked, the principal dies, or a condition is broken. It is important that the executor deliver copies to their agent and any other relevant parties, as well as preserve a copy for their own records.

Frequently Asked Questions (FAQ)

Is a Durable Power of Attorney Valid After Death?

No. Upon the passing of the granting party, the instrument will automatically become void.

What Is a Durable Power of Attorney for Health Care?

A document that allows someone to appoint an agent to make medical decisions for them if they ever enter a state of incapacitation. Visit our medical power of attorney page for more information.

What Rights Does the Agent of a Durable Power of Attorney Have?

This can vary depending on the selections made by the principal when executing the document, but in general, the agent will have the right to act as the principal in regard to their financial matters.

For example, if the principal grants full access to their attorney-in-fact, they will have the ability to carry out bank transactions, tax filings, property dealings, etc. This means that the attorney-in-fact can sign and receive any paperwork in order to complete the assigned tasks.

Does a Durable Power of Attorney Expire?

Only if the principal revokes the authority, dies, or a provision is violated.

Does a Durable Power of Attorney Need to Be Notarized?

The majority of states within the U.S. require DPOAs to be notarized and/or witnessed by two (2) qualified individuals. With that being said, it is recommended that executors research their local signing laws before supplying their endorsement.

When Does a Durable Power of Attorney Become Effective?

The answer to this question relies on the content of the signed document. Individuals executing a DPOA can specify whether or not they want the instrument to go into effect immediately, on a specific date, or at the time of their incapacity.

Can a Durable Power of Attorney Be Revoked?

Yes. The granting party may revoke the authority that they conveyed at any time. It is highly recommended (and many times legally required) that this be achieved through the use of a revocation form that can be delivered to the agent as notice.

Do I Need a Durable Power of Attorney?

It is never required to execute a DPOA, it is merely an option for any party interested in planning for the future.

Can You Have More Than One Durable Power of Attorney?

Most states allow their residents to appoint multiple agents in a power of attorney. With that being said, grantors should still check their local laws to see if this is a legal option.

Some forms will provide areas to name “co-agents”, which are individuals who can operate on the principal’s behalf simultaneously. Other versions will have a section where you can write in “successor agents” that will only take effect if the primary attorney-in-fact resigns.

How Do You Sign a Document as an Attorney-in-Fact?

In order for an attorney-in-fact to sign as the grantor, they must use the following method below:

- (Principal’s Name) by (Your Signature) as Agent

Who Signs a Durable Power of Attorney?

The principal will always have to sign their name to the DPOA. Some states may require the agent to sign as well. Executors should wait to perform their signature until they are in the presence of a notary public and/or witnesses to verify the endorsements.

What Is the Difference Between a Durable and General POA?

A durable POA remains effective even if the principal becomes unable to make their own decisions, whereas a general POA terminates upon their incapacitation.

What Is a Statutory Power of Attorney?

Various states within the country contain their own version of the POA within the statutes of their law code, this is referred to as a “statutory power of attorney”.

Sample Durable Power of Attorney

Download: Adobe PDF, MS Word (.docx)