By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

What is a State Tax Power of Attorney

When an individual or company hires a professional to handle their associated taxes, written permission must first be instated to approve the designated rights. State-specific POA agreements are made available to convey privileges regarding one’s tax account to an identified “agent” (or “attorney-in-fact“). The distributed controls can allow the attorney-in-fact to communicate with the state’s respective tax division and receive confidential information about the principal party’s tax record. Depending on how the form is completed, the named agent can be issued powers to make decisions, sign paperwork, and perform tasks on behalf of the taxpayer.

When to Use a Power of Attorney for Tax Purposes

Addressing tax situations can be an intricate matter that may require the expertise of a specialist under certain circumstances. Express approval to bestow representation rights must be authorized to qualify an outside party to manage their tax affairs. The use of the document can be instituted for standard filing and disclosure purposes or initiated upon receiving notification of a complication with an account or notice of an audit. Most states supply a specific version to document the arrangement that must be completed and executed to endow the assigned powers. Make sure to click on the link associated with your state of residence to acquire the correct form for submission.

How to Issue Powers of Attorney for State Taxes

- Step 1 – Select a Designated Representative

- Step 2 – Complete and Sign the Document

- Step 3 – Submit the Form as Instructed

Step 1 – Select a Designated Representative

Once a taxpayer decides to retain representation for their individual or business tax proceedings, an attorney-in-fact can be selected for appointment. Revise the legislature on the matter pertaining to your particular state government, as some states demand that the representative be accredited as a licensed attorney, certified public accountant, or enrolled agent. Although this may be a requirement for some states, others may allow family members or friends to take on the designation, as long as they are considered an adult of sound mind. Upon commissioning an expert, you will want to gather their information to complete the paperwork as needed.

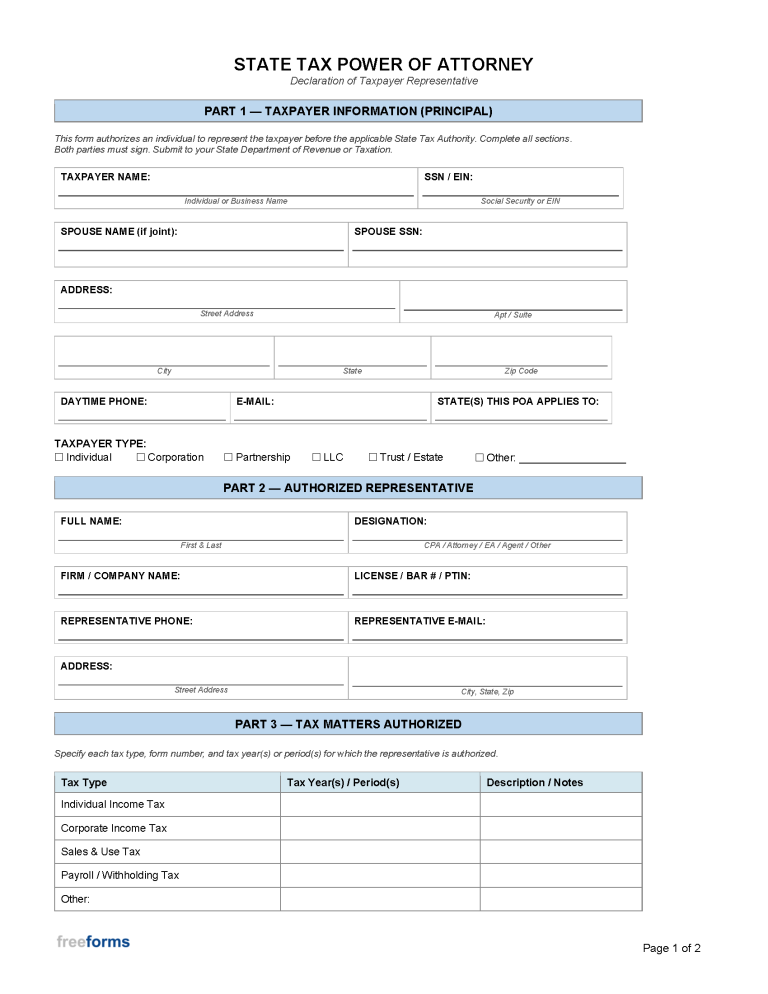

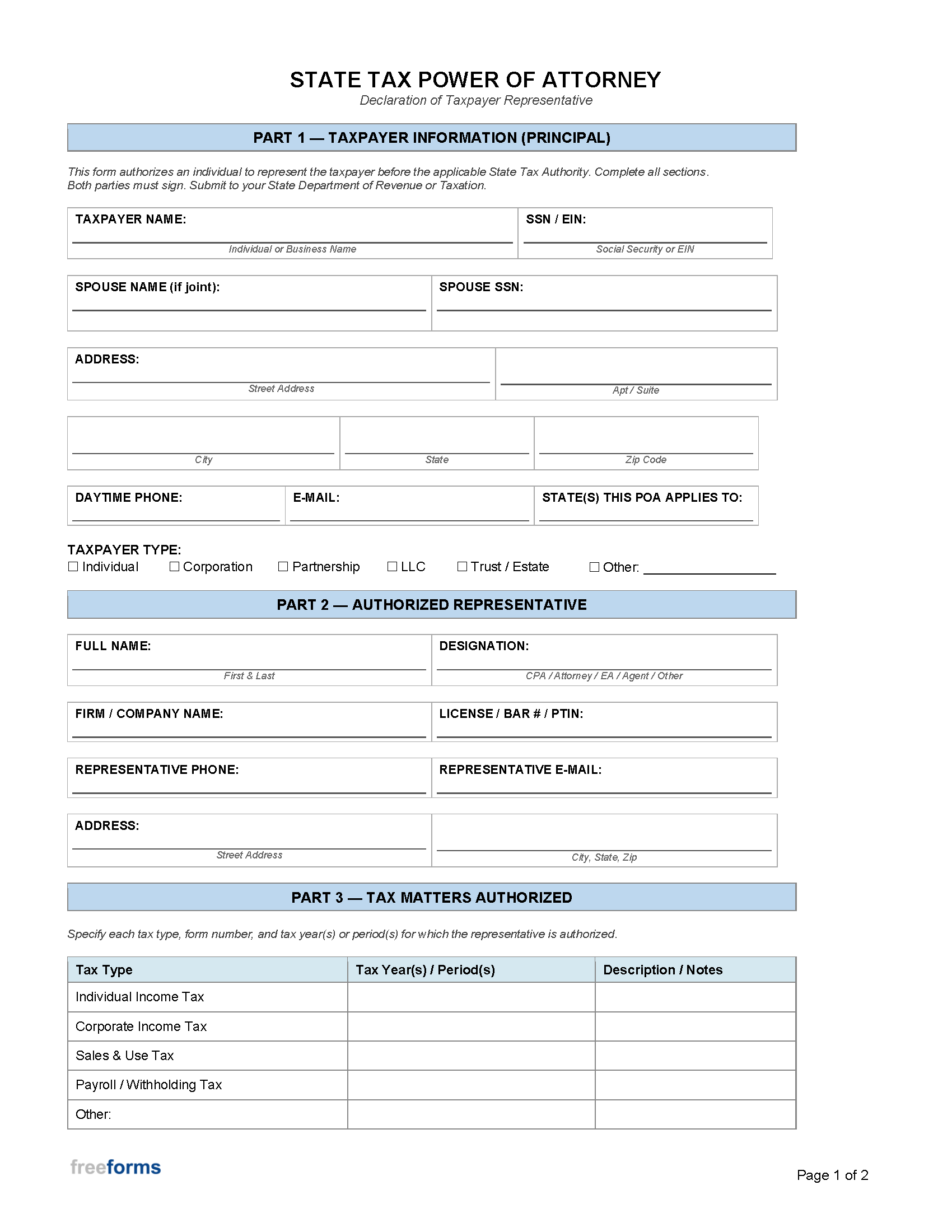

Step 2 – Complete and Sign the Document

Once an attorney-in-fact has been chosen, you will need to visit your state’s tax POA page to obtain the appropriate form. After selecting the link, you can download the PDF, print the file, or fill in the electronic form by clicking the “Fill Now” button. Enter the indicated information on the taxpayer (or business) and agent into the blank spaces as directed. The issuing principal will have the opportunity to grant the represenative the power(s) to:

- Receive Confidential Tax Account Information

- Communicate or Appear on behalf of the principal

- Submit Adjustments or Appeals

- Execute Official Tax Documents (returns, waivers, settlements, closing agreements)

- Receive Refund Payments

The delivered controls can be extended as desired in a broad or limited manner according to how the declarant completes the document. The connected participants can then sign the paperwork and prepare for submission. Refer to your state’s page for potential notarization requirements for endorsements.

Step 3 – Submit the Form as Instructed

The procedure for registering a POA and the recognized tax department differs for every state, and each one has separate practices for gaining government approval. The most common methods to effectively deliver the executed form are by:

- eFile

- Fax

- Certified Mail

- In-Person Submission

Examine your state’s page to review the specific process for sending in the paperwork, to ensure that all necessary standards have been met. After receiving the document, the state authority will sanction or deny the arrangement and notify the parties involved.

Frequently Asked Questions (FAQs)

Does Every State Provide a Specific Power of Attorney Tax Form?

No. Although many states furnish a unique tax power of attorney document, Delaware, Nevada, and Wyoming choose to accept the IRS Power of Attorney (Form 2848) to issue representation privileges. Follow the instruction according to your state page to send in for approval.

Is Power of Attorney Required to File Jointly?

Not typically. When a joint tax return is filed, signatures from both spouses must be received in most cases. In the event a spouse is not present to endorse the document, the other will need to be authorized via a power of attorney to sign in their absence legally. However, if one spouse cannot sign due to mental or physical incapacity, the other can endorse the document for them without an existing POA in place.

Do I need to File a Separate POA for Federal Taxes?

Yes. Submitting and establishing a declared agent for your taxes on the state level does not approve the same permissions for federal tax use. Granting federal tax power(s) to an attorney-in-fact requires finalization, delivery, and acceptance of an IRS Power of Attorney (Form 2848). The exact completion, endorsement, and delivery procedure can be found on the IRS Power of Attorney (Form 2848) page.

Can a Power of Attorney Sign a Tax Return?

When transferring agency to a power of attorney (more commonly denoted as “attorney-in-fact” or “agent”), the precise permitted controls are defined within the POA filing. Several states allow a nominated attorney-in-fact to sign documents on behalf of the principal taxpayer, while others prohibit the action. Check the form for your state to determine if it includes a language to enable the provision.

Federal Taxes:

The IRS insists that tax returns must be endorsed by the taxpayer for the majority of situations. Per the Internal Revenue Code (26 CFR § 1.6012-1(a)(5)), a designated tax representative can execute a return only in cases where the taxpayer is unable to sign due to:

- Serious Injury or Illness

- Prolonged Absence from the U.S. (at least sixty (60) days before the prescribed tax return due date)

Alternatively, the taxpayer can extend a request for the concession in writing to the district director. If the claim is deemed reasonable, approval for the exception can be recognized, and the agent can execute the document.