Laws

Statute – § 709.2201

Definition – § 709.2102(9)

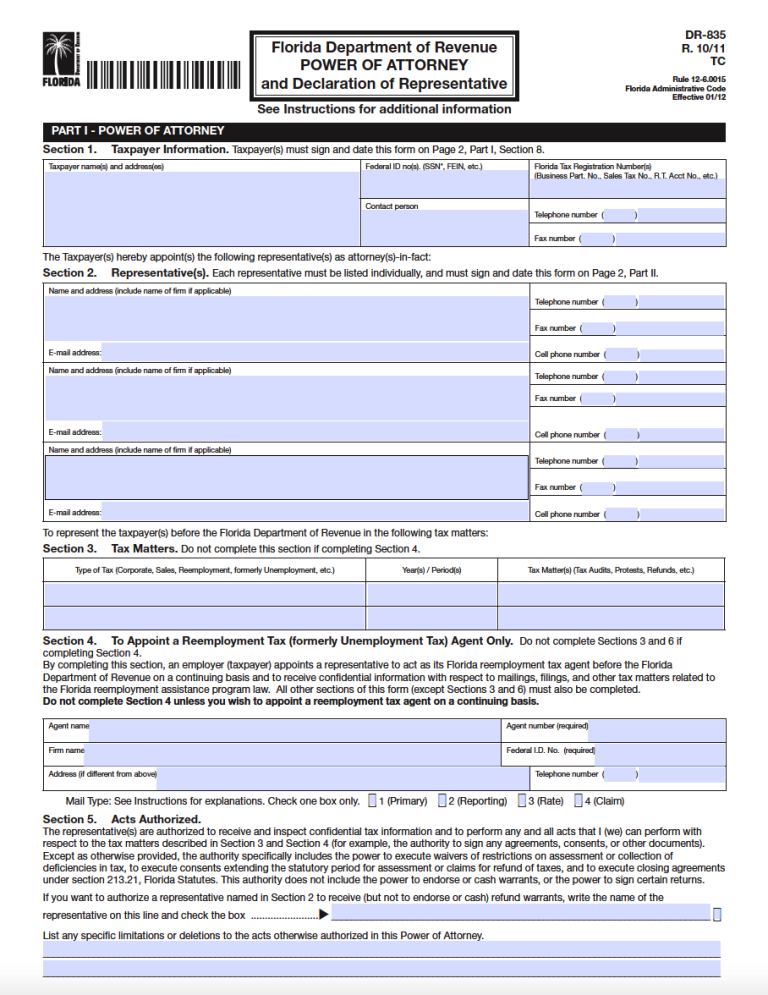

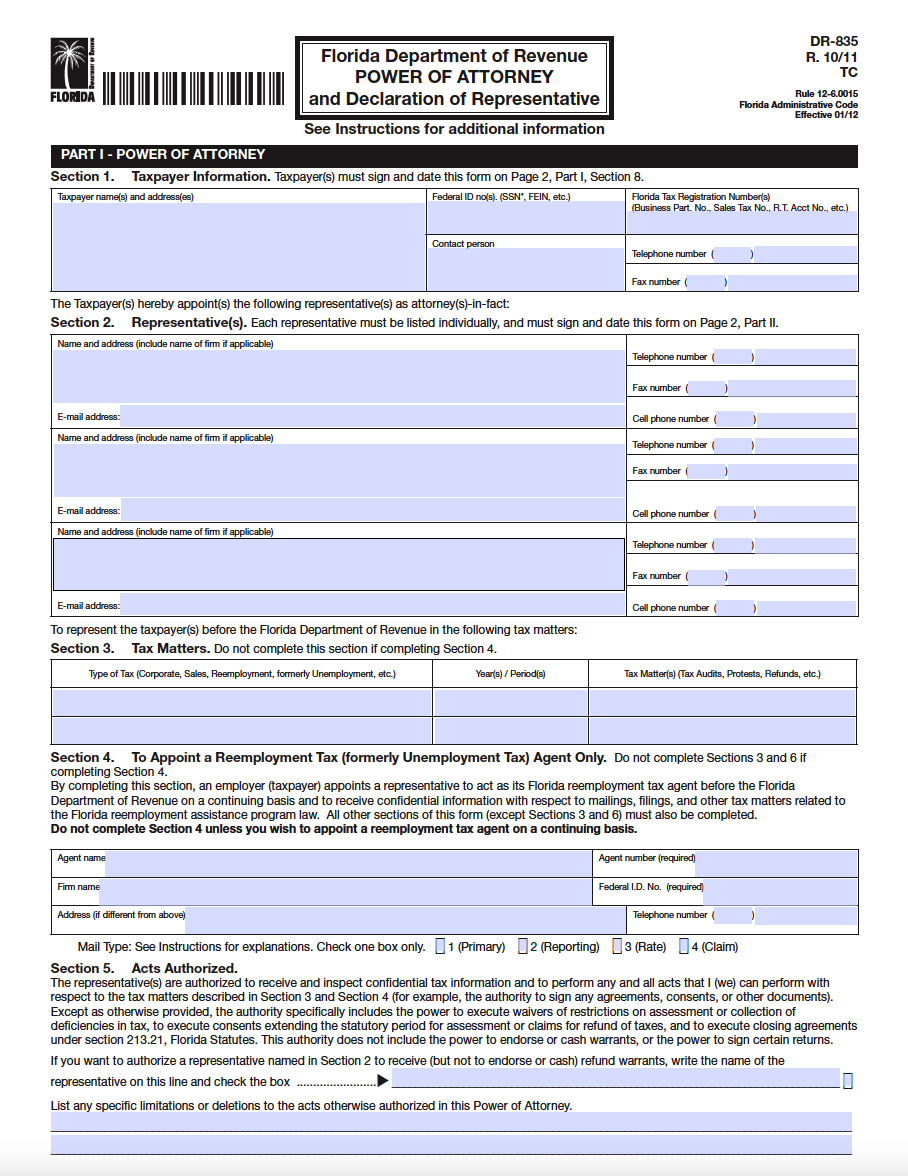

Signing Requirements – This document necessitates the signatures of the taxpayer(s) and representative(s).

Additional Resources

Florida Department of Revenue – Tax Power of Attorney (Form DR-835) Instructions

Related Forms

- Durable (Financial) Power of Attorney

- General (Financial) Power of Attorney

- Limited (Special) Power of Attorney

- Revocation of Power of Attorney

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

General (Financial) Power of Attorney

General (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Limited (Special) Power of Attorney

Limited (Special) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF