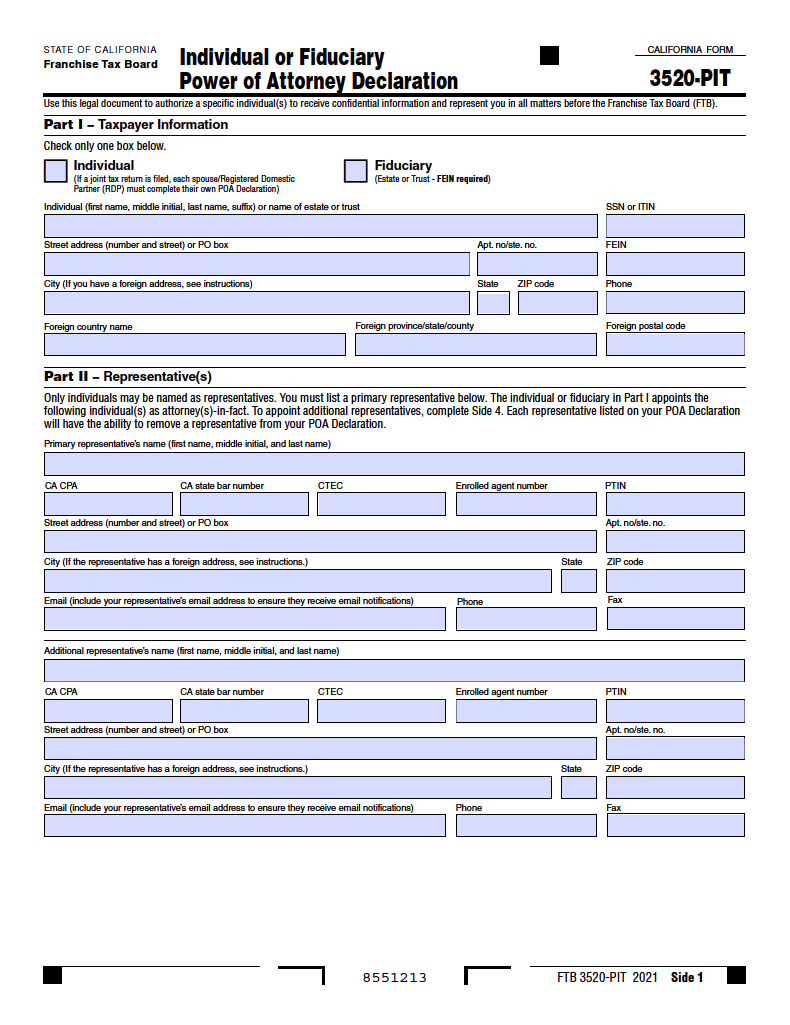

The California State Tax Power of Attorney is the routine document carried out by individuals or fiduciaries seeking to allow another person or company to manage certain tax-related functions in their name. For example, if somebody wishes to assign their accountant or attorney to file or pay their taxes, they can do so with the fulfillment of this written instrument. It will require the individual or fiduciary to list the unique personal details of each party, the types of powers they would like to deliver access to, and any guidelines concerning the authority granted.

Instructions: Adobe PDF

Laws

Statute – California Probate Code: Division 4.5. Powers of Attorney (§ 4000 – 4545)

Signing Requirements – This document requests that the principal (taxpayer) sign in the designated area of the form.

How to File

To institute the designated controls to an appointed agent, you must first submit the applicable power of attorney form to the California Franchise Tax Board for approval. The fastest method of submission can be achieved by creating and/or logging in to your myFTB account. For those that wish to send the document via physical mail, use the following provided address:

POA/TIA Unit

Franchise Tax Board

PO Box 2828

Rancho Cordova, CA 95741-2828

Other Versions

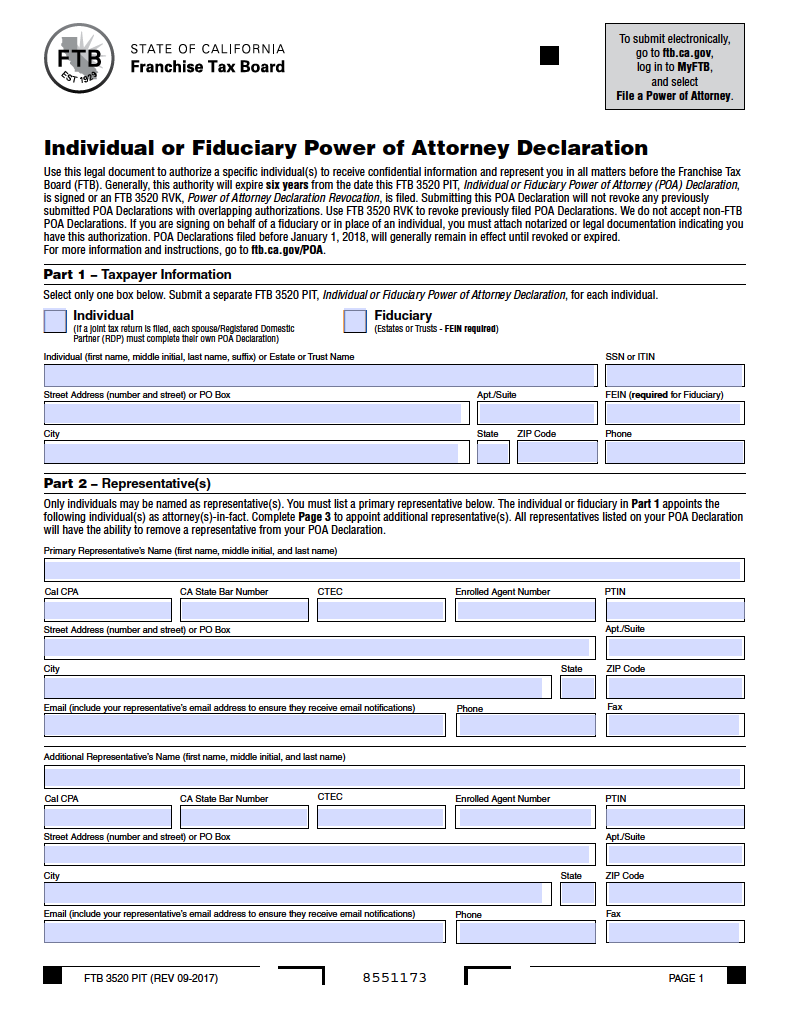

Tax Power of Attorney (Form FTB 3520-PIT) (Previous Edition)

Download: Adobe PDF

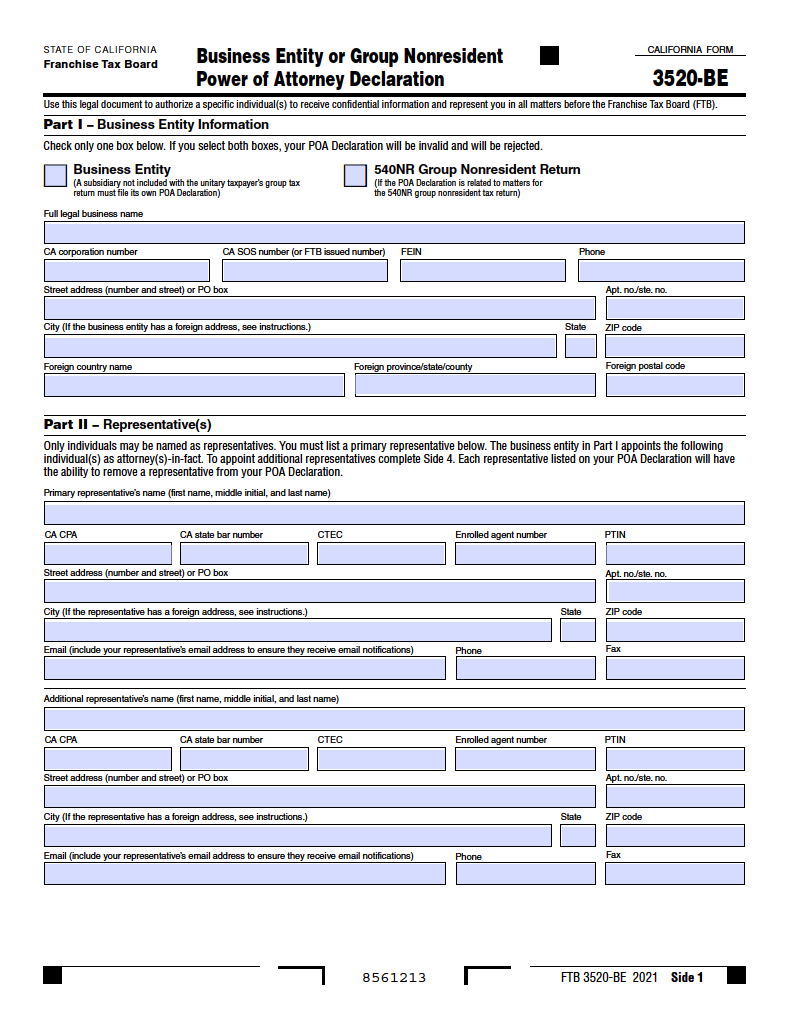

Tax Power of Attorney for Business Entity or Group Nonresident (Form FTB 3520-BE)

Tax Power of Attorney for Business Entity or Group Nonresident (Form FTB 3520-BE)

Download: Adobe PDF

Instructions: Adobe PDF

Additional Resources

- Superior Court of CA Orange County – Power of Attorney

- State of CA Franchise Tax Board – Manage Your Power of Attorney Relationships

- State of CA Franchise Tax Board – Power of Attorney

Related Forms (3)

- Durable (Financial) Power of Attorney Form

- Revocation of Power of Attorney

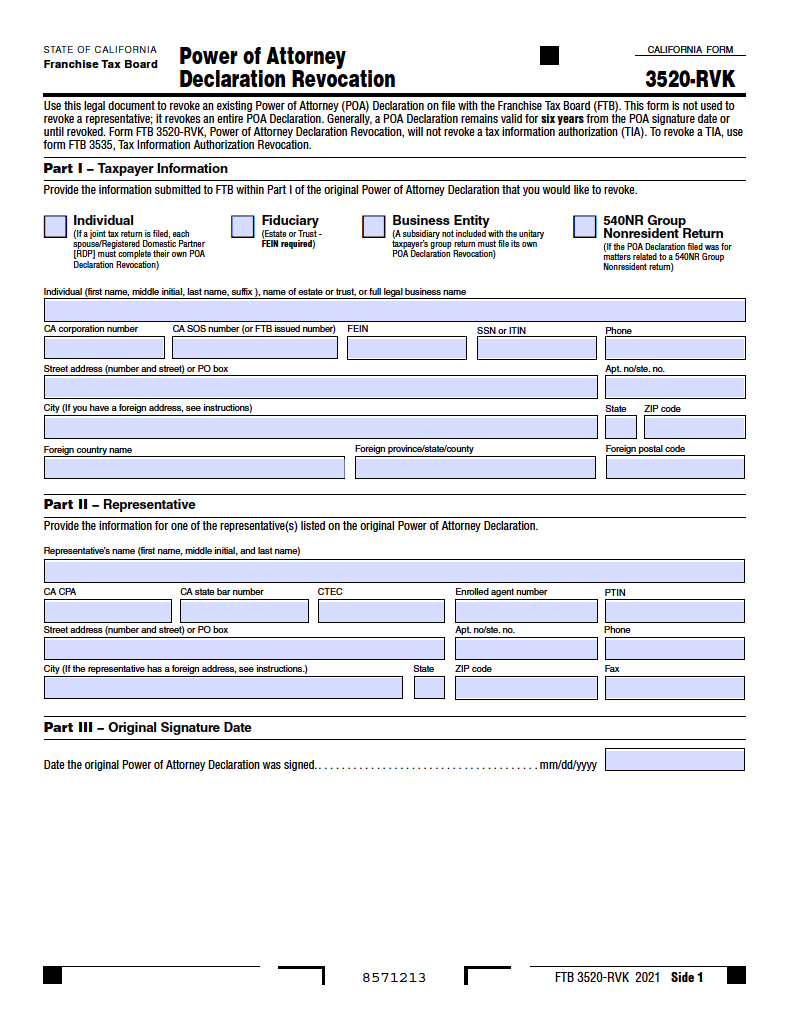

- Revocation of State Tax Power of Attorney

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF

Revocation of State Tax Power of Attorney (Form FTB 3520-RVK)

Revocation of State Tax Power of Attorney (Form FTB 3520-RVK)

Download: Adobe PDF

Instructions: Adobe PDF