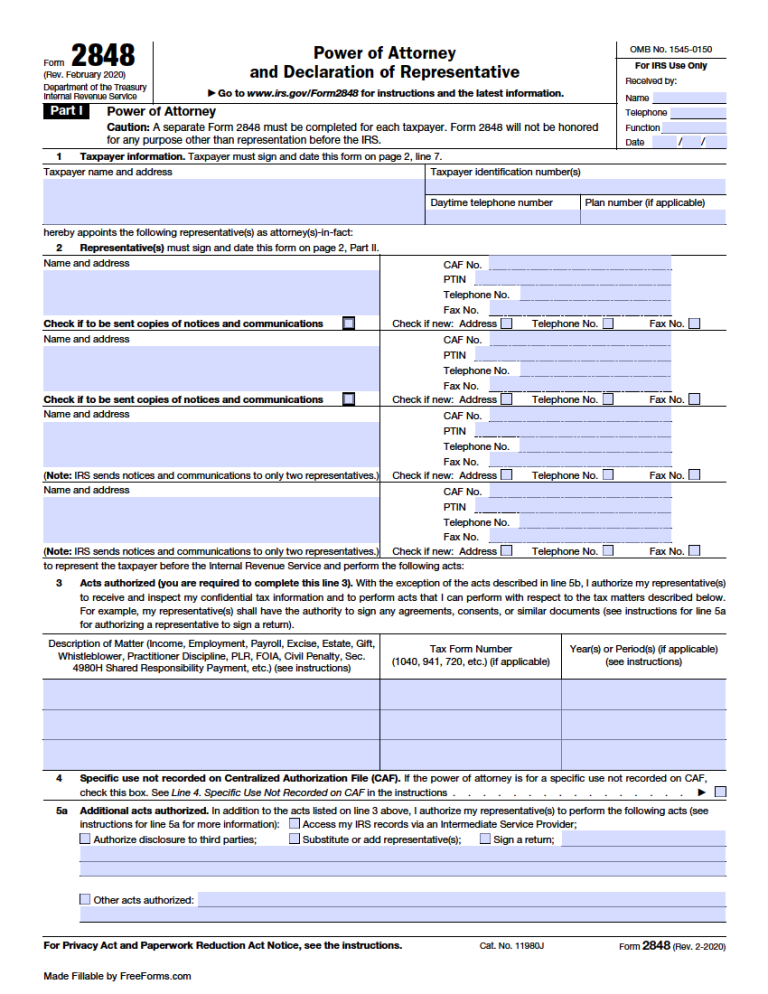

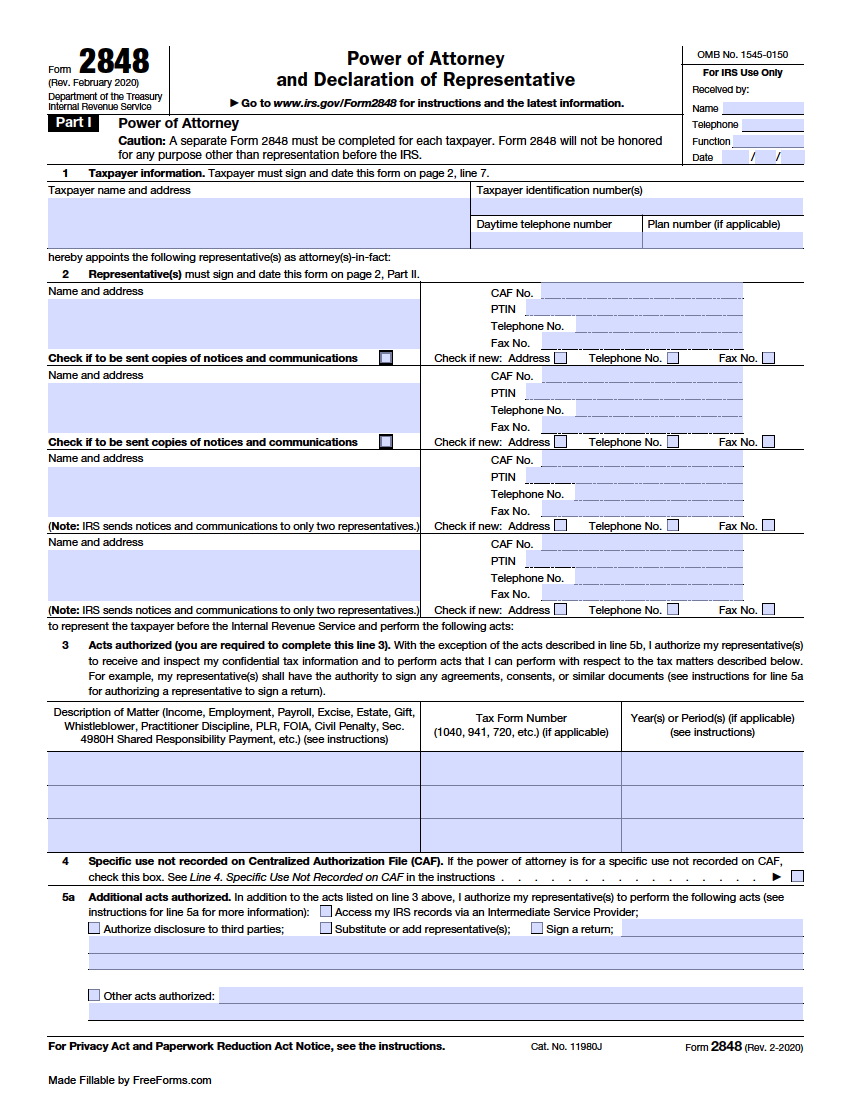

All the parties have to do is provide the personal details of each individual involved, indicate what actions can be performed, and supply signatures as necessary. Following the completion of the document, the form should be sent to the applicable division of the IRS in order for the request to be processed.

What is the IRS Power of Attorney?

When filing federal taxes, an individual or registered business can authorize the services of a tax professional to handle their associated account with the Internal Revenue Service. In these cases, the federal government supplies Form 2848 to legally entitle a specialist with privileges to deal with the IRS regarding another’s taxes, with express permission from the taxpayer, corporate officer, or indicated agent for a company. Filing of the document is generally necessary for the representative to perform the following actions concerning the taxes of a client:

- Communicating with the IRS

- Signing on the Taxpayer’s/Business’s Behalf

- Negotiating Payments

- Gaining Access to Tax Documents and Confidential Information

- Appealing Possible Disputes

The allotted acts granted are based on how the principal party completes the form. Adjustments can be made to bestow limited or broad power(s) depending on the need of the declarant. The paperwork is typically employed in the event of an audit, allowing an expert to consult directly with the IRS on behalf of the taxpayer. When dealing with taxes on the state level, a separate POA form is generally provided and can be acquired on the State Tax Filing page.

How to Submit a Power of Attorney to the IRS

For an individual or firm to speak on behalf of a taxpayer or corporate officer, the official request requires submission and approval through the proper channels. The process for documenting and filing the arrangement is outlined in the indicated steps below.

- Step 1 – Choose an Eligible Representative

- Step 2 – Complete and Sign the Document

- Step 3 – Submit the Form to the IRS

Step 1 – Choose an Eligible Representative

Assigning rights of representation is standard practice for those seeking professional assistance related to complicated tax matters. When selecting an agent, it is critical to allocate the designation to a reputable and responsible party since they will be granted high-level controls to make tax decisions. The nominated attorney-in-fact must also meet the criteria of one of the following professional classifications to be instated:

- Certified Public Accountant

- Licensed Attorney

- Enrolled Agent/Actuary

- Affiliated Corporate Officer or Full-Time Employee (for business tax accounts)

An additional exception allows a chosen family member of the principal to be named as a declared representative without necessarily being designated as a qualifying tax expert.

Step 2 – Complete and Sign the Document

Next, the IRS Power of Attorney (Form 2848) can be downloaded, printed, or completed by using our site’s Fill Now option as needed to finalize the action. Complete the filing by entering the corresponding information as prompted within the document. Record the names, addresses, and contact information related to the taxpayer(s) and designated agent(s), as well as the corresponding tax ID number associated with the account. Confirm the specified acts of representation to be granted and denote any desired limitations on issued controls. Once the paperwork is filled out, endorsements from the involved parties can be applied where instructed. Corroboration from a notary public is not necessary to validate the form’s execution.

Step 3 – Submit the Form to the IRS

After sufficient completion and execution of the form, it will need to be submitted and approved to institute the identified powers. There are three (3) accepted methods to file with the IRS to successfully deliver the request for declared representation, as explained below:

e-file:

Electronic submission of the document can be carried out by utilizing the IRS website’s e-Services Tool. Upon selecting the link, you will be redirected to the secure government site. Click the “Log In to Submit” button, and on the next page, you will have the opportunity to either create an account or sign in to an existing account. Once an account is established, follow the site’s instructions to submit the form.

Mail or Fax

Several regional offices are available for those who elect to physically mail or fax the document. Depending on your state of residence, use of the table below will determine which address or fax number corresponds to your state for proper submission:

State of Residence |

Mailing Address |

Fax Number |

|---|---|---|

| Alabama, Arkansas, Connecticut, Delaware, District of Columbia, Florida, Georgia, Illinois, Indiana, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, or West Virginia | Internal Revenue Service 5333 Getwell Road Stop 8423 Memphis, TN 38118 |

(855) 214-7519 |

| Alaska, Arizona, California, Colorado, Hawaii, Idaho, Iowa, Kansas, Minnesota, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wisconsin, or Wyoming | Internal Revenue Service 1973 Rulon White Blvd., MS 6737 Ogden, UT 84201 |

(855) 214-7522 |

| All APO and FPO addresses, American Samoa, the Commonwealth of the Northern Mariana Islands, Guam, the U.S. Virgin Islands, Puerto Rico, a foreign country, or otherwise outside the United States | Internal Revenue Service International CAF Team 2970 Market Street MS: 4-H14.123. Philadelphia, PA 19104 |

(855) 772-3156OR (304) 707-9785 |

After the IRS has received the form, receipt of submission and acceptance will be communicated instating the approved agency.

Frequently Asked Questions (FAQ)

How Do I Revoke a Federal Tax Power of Attorney?

If the principal party no longer needs the designated attorney-in-fact to represent them on federal tax issues, cancellation of the arrangement can be issued. Revocation of the distributed authorization(s) can be attained by amending the original form by inscribing “REVOKE” at the top of the first page. The modified document will then need to be resubmitted to the IRS as described in Step 3. Copies of the revised paperwork should be distributed to the former declared representative(s) and retained by the principal.

What is the difference between Form 2848 and Form 8821?

IRS Form 2848 conveys powers to an appointed agent to manage an individual’s (or business’s) federal taxes. In cases where the issuance of power(s) to communicate, act, or sign is unnecessary, but approved disclosure of confidential tax information is needed, Form 8821 can be used instead. The IRS Tax Information Authorization Form 8821 can be filed with the federal government to formally approve the sole designation for a named individual to obtain confidential tax information on an account. The paperwork can be submitted in the same manner, either online, by fax, or by mail as directed in Step 3 above for the IRS Form 2848.

Instructions: Adobe PDF

Do I Need to File a Separate Power of Attorney For State Taxes?

Most U.S. states have created a unique tax POA form for registering a representative for associated state tax matters. For state taxes, you can obtain the State Tax Filing that corresponds to your state of residency. Although most states provide a form to file powers of attorney for taxes, Maryland, Kentucky, and Delaware do not furnish a separate document and rather accept the federal Form 2848 instead.

Can I Change the Address for My Declared Representative?

Yes. The nominated agent can simply mail a written notification of the change to the appropriate regional office to adequately inform the IRS of the updated address. Once the correspondence is received, the IRS will adjust the record accordingly.