The Oregon Power of Attorney is a standardized legal form produced to bestow a particular set of controls from a principal to an agent, allowing them to speak and act on their behalf. Depending on the user’s need, the utilized POA can be instated to grant powers within many areas, including financial, medical, legal, minor (child), or tax matters. The declarant can adjust the provided contract to issue a broad or limited amount of privileges, contingent on the necessity of the situation. The medical form, or advance directive, can not only institute the agency of an individual to make decisions for the principal party but can additionally allow a space to record preferences in regard to handling medical treatments moving forward. Both the medical and durable documents allow attorney-in-fact permissions that are acquired once a declaring individual becomes incapacitated. Although the commitments issued by the presented forms can be carried out without the help of an attorney, it is advised to consult with those close to you and perhaps a legal professional before executing the arrangement.

Laws

Definition – “When a principal designates another person as an agent by a power of attorney in writing, and the power of attorney does not contain words that otherwise delay or limit the period of time of its effectiveness:

Signing Requirements – A supervising notary or two (2) witnesses are required for the certification of an advance directive. Designation of notarization requirements is not stipulated for financial POAs, but having a notary public to oversee the process is strongly recommended to authenticate the transaction (§ 127.515(2)).

Revocation – § 127.772

By Type (9)

- Advance Directive (Medical POA & Living Will)

- Durable (Financial) Power of Attorney

- General (Financial) Power of Attorney

- Limited (Special) Power of Attorney

- Minor Child Power of Attorney

- Motor Vehicle Power of Attorney

- Real Estate Power of Attorney

- Revocation of Power of Attorney

- Tax Power of Attorney

Advance Directive (Medical POA & Living Will) – Designates a registered account of desired medical treatment options and representation for a patient as a preparatory measure.

Advance Directive (Medical POA & Living Will) – Designates a registered account of desired medical treatment options and representation for a patient as a preparatory measure.

Download: PDF

Signing Requirements: Acknowledgement by a professional notary or two (2) witnessing parties is mandated to properly instill the document’s arrangement.

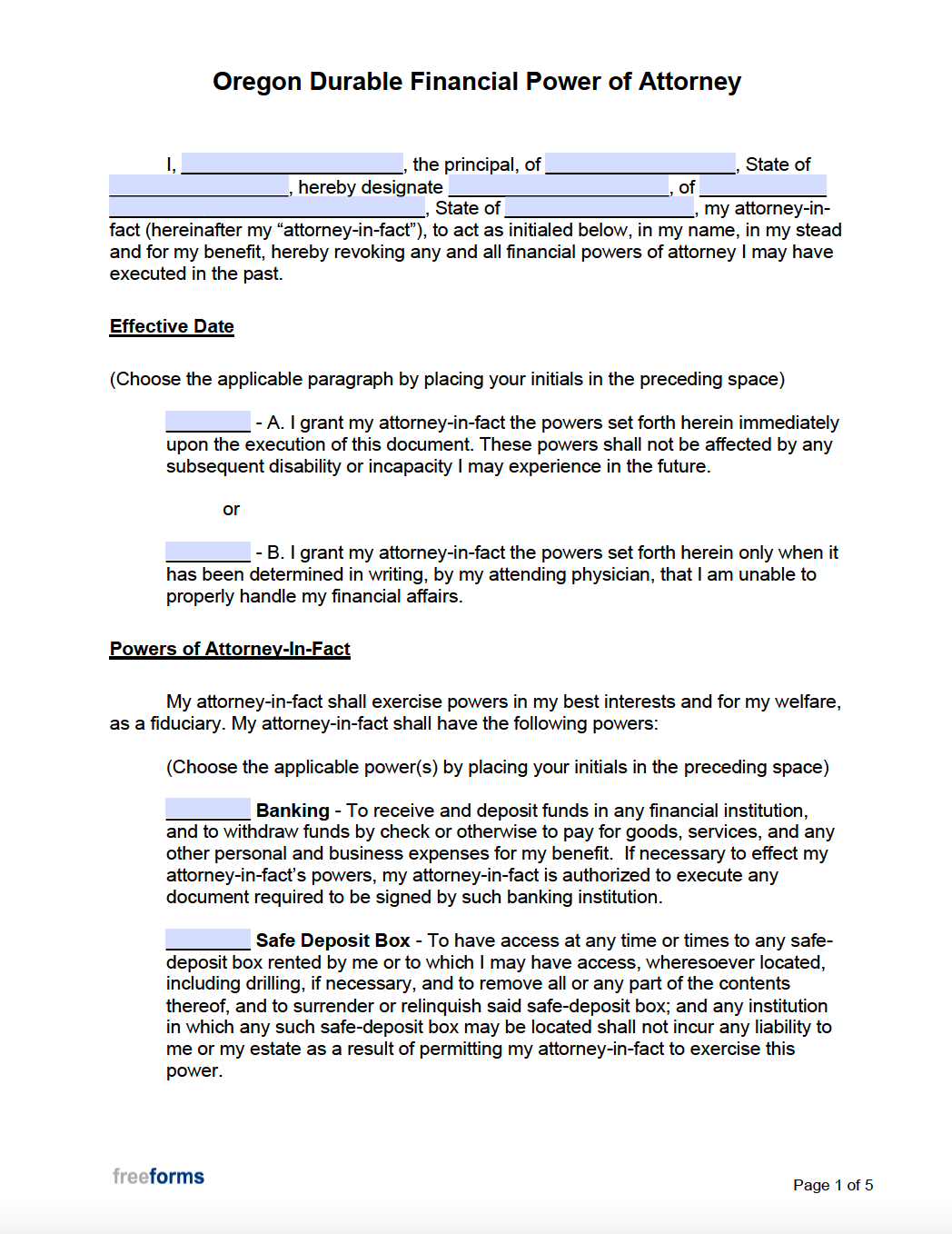

Durable (Financial) Power of Attorney – Bestows controls to an alternate party to manage indicated financial assets, tax issues, or legal proceedings on behalf of a principal.

Durable (Financial) Power of Attorney – Bestows controls to an alternate party to manage indicated financial assets, tax issues, or legal proceedings on behalf of a principal.

Download: PDF, Word (.docx)

Signing Requirements: Although acknowledgment is not necessitated according to the Oregon Revised Statutes, it is recommended to have the form notarized to certify the commitment.

General (Financial) Power of Attorney – Collects related information to assign an attorney-in-fact agency over a person’s designated financial holdings on a broad scope.

General (Financial) Power of Attorney – Collects related information to assign an attorney-in-fact agency over a person’s designated financial holdings on a broad scope.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgement by a notary is not obligated to confirm endorsements and extend the associated powers.

Limited (Special) Power of Attorney – Determines the finite choice rights that are to be allocated to another as stated within the document.

Limited (Special) Power of Attorney – Determines the finite choice rights that are to be allocated to another as stated within the document.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgement by signature must be delivered by the involved parties and does not require a notary or witnessing individual validation.

Minor Child Power of Attorney – Contracts lawful standing of another person to care for a minor temporarily without the child’s parent(s).

Minor Child Power of Attorney – Contracts lawful standing of another person to care for a minor temporarily without the child’s parent(s).

Download: PDF

Signing Requirements: Acknowledgement by the notary public is not mandated by the state of Oregon, but it can further certify the commitment.

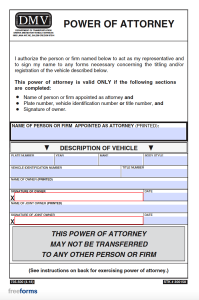

Motor Vehicle Power of Attorney (Form 735-500) – Outlines the establishment of rights for another to perform administrative acts pertaining to a vehicle owned by someone else.

Motor Vehicle Power of Attorney (Form 735-500) – Outlines the establishment of rights for another to perform administrative acts pertaining to a vehicle owned by someone else.

Download: PDF

Signing Requirements: Acknowledgement via signature is required by all owning individuals.

Real Estate Power of Attorney – Passes defined permissions from a declarant to an attorney-in-fact allowing access to manage, buy, sell, and/or finance the real property for an owner.

Real Estate Power of Attorney – Passes defined permissions from a declarant to an attorney-in-fact allowing access to manage, buy, sell, and/or finance the real property for an owner.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgment by a notary or disinterested witness(es) is not legally demanded, but it is generally advised for transactions of this nature.

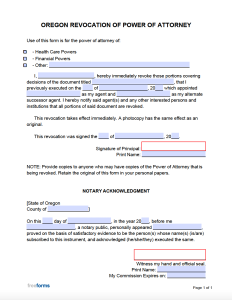

Revocation of Power of Attorney – Collects information to rescind a previously contracted power of attorney document.

Revocation of Power of Attorney – Collects information to rescind a previously contracted power of attorney document.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgement by the declarant of the original commitment must sign the form to cancel the agreement effectively.

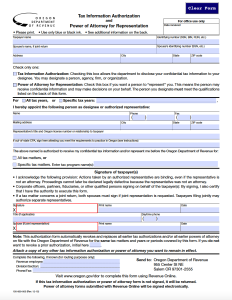

Tax Power of Attorney (Form 150-800-005) – Appoints a specialist the legal ability to be privy to and/or address state tax business for a named individual or individuals.

Tax Power of Attorney (Form 150-800-005) – Appoints a specialist the legal ability to be privy to and/or address state tax business for a named individual or individuals.

Download: PDF

Signing Requirements: Acknowledgement by way of endorsements from all included taxpayers will fulfill the accord.