The Indiana Power of Attorney is something to consider when you are interested in giving someone legal permission to carry out acts in your name. There are multiple different versions of the document that contain varying powers (financial, medical, childcare), terms (durable, general/non-durable, springing), and signing requirements. All variations of this document will request the details of both parties involved (principal & attorney-in-fact), a selection of powers (& their limitations), and the overall conditions of the conveyance. This is all finalized by the principal endorsing the instrument as requested by the state which will depend on the form used.

Laws

Statutes – Title 30, Article 5: Powers of Attorney (§ 30-5)

Definition – “Power of attorney” means a writing or other record that grants authority to an attorney in fact or agent to act in place of a principal, whether the term “power of attorney” is used (§ 30-5-2-7).

Signing Requirements – Acknowledgment of Notary Public (§ 30-5-4-1(4))

By Type (11)

- Advance Directive (Medical POA & Living Will)

- Durable (Financial) Power of Attorney

- General (Financial) Power of Attorney

- Limited (Special) Power of Attorney

- Living Will

- Medical Power of Attorney

- Minor Child Power of Attorney

- Motor Vehicle Power of Attorney

- Real Estate Power of Attorney

- Revocation of Power of Attorney

- Tax Power of Attorney

Advance Directive (Medical POA & Living Will) – A document accomplished in advance to plan for potential future scenarios involving the declarant’s/principal’s health status & incapacitation.

Advance Directive (Medical POA & Living Will) – A document accomplished in advance to plan for potential future scenarios involving the declarant’s/principal’s health status & incapacitation.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgment of one (1) witness for the appointment section (§ 16-36-1-6(a)(3)), two (2) witnesses for the declaration section (§ 16-36-4-8(b)(5)).

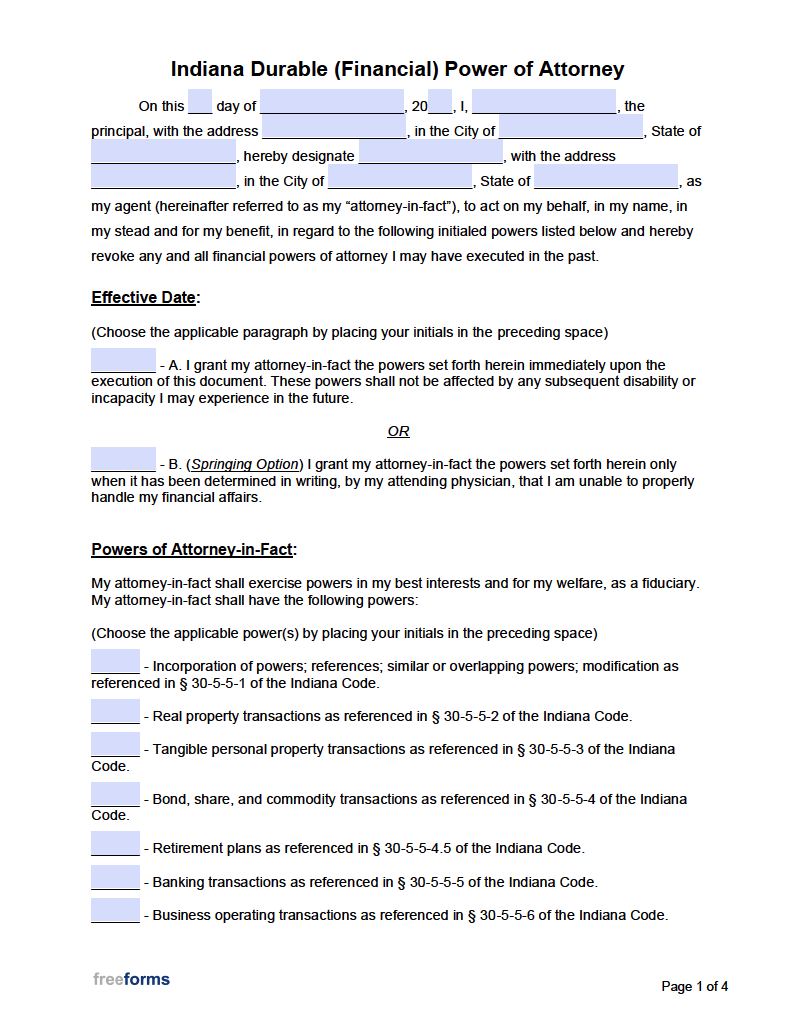

Durable (Financial) Power of Attorney – Constructs a principal-agent relationship where the attorney-in-fact is entitled to perform financial assignments in the granting party’s name. (Does not terminate upon incapacitation.)

Durable (Financial) Power of Attorney – Constructs a principal-agent relationship where the attorney-in-fact is entitled to perform financial assignments in the granting party’s name. (Does not terminate upon incapacitation.)

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgment of Notary Public (§ 30-5-4-1(4))

General (Financial) Power of Attorney – Let’s users select from a list of financial powers to convey unto a third-party representative. (Terminates if the principal becomes incapacitated.)

General (Financial) Power of Attorney – Let’s users select from a list of financial powers to convey unto a third-party representative. (Terminates if the principal becomes incapacitated.)

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgment of Notary Public (§ 30-5-4-1(4))

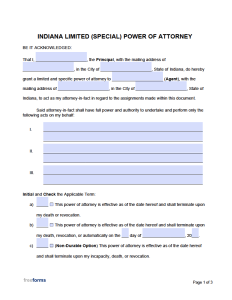

Limited (Special) Power of Attorney – A POA that can be tailored to the needs of its executor by allowing them to insert their own powers/duties within the spaces provided.

Limited (Special) Power of Attorney – A POA that can be tailored to the needs of its executor by allowing them to insert their own powers/duties within the spaces provided.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgment of Notary Public (§ 30-5-4-1(4))

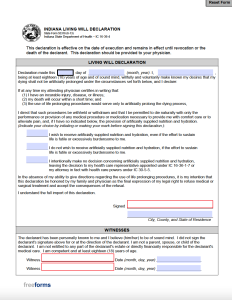

Living Will – A premeditative measure where a declarant can record their preferences for end-of-life care in case they become incapacitated and unable to voice their own wishes.

Living Will – A premeditative measure where a declarant can record their preferences for end-of-life care in case they become incapacitated and unable to voice their own wishes.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgment of Two (2) Witnesses (§ 16-36-4-8(b)(5))

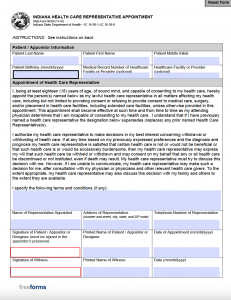

Medical Power of Attorney – Individuals who have a person they trust to make decisions on their behalf regarding healthcare at the time of incapacity may execute this form to appoint them as their representative/agent.

Medical Power of Attorney – Individuals who have a person they trust to make decisions on their behalf regarding healthcare at the time of incapacity may execute this form to appoint them as their representative/agent.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgment of One (1) Witness (§ 16-36-1-6(a)(3))

Minor Child Power of Attorney – Utilized by mothers/fathers/guardians who wish to delegate parental powers to an attorney-in-fact so that they may authorize medical treatment and/or enroll the child in school.

Minor Child Power of Attorney – Utilized by mothers/fathers/guardians who wish to delegate parental powers to an attorney-in-fact so that they may authorize medical treatment and/or enroll the child in school.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgment of Notary Public (§ 30-5-4-1(4))

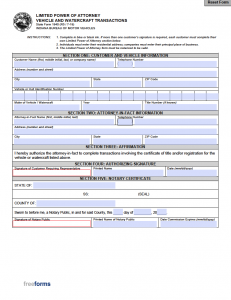

Motor Vehicle Power of Attorney – Permits a person other than the owner or purchaser to carry out a vehicle transaction on their behalf.

Motor Vehicle Power of Attorney – Permits a person other than the owner or purchaser to carry out a vehicle transaction on their behalf.

Download: PDF

Signing Requirements: Acknowledgment of Notary Public (§ 30-5-4-1(4))

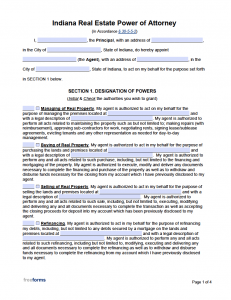

Real Estate Power of Attorney – An instrumental document for individuals who need another person to carry out real estate dealings in their name, e.g., selling, purchasing, managing, & financing.

Real Estate Power of Attorney – An instrumental document for individuals who need another person to carry out real estate dealings in their name, e.g., selling, purchasing, managing, & financing.

Download: PDF, Word (.docx)

Signing Requirements: Acknowledgment of Notary Public (§ 30-5-4-1(4))

Revocation of Power of Attorney – When a principal feels it’s time to end the conveyance of authority, they can cancel it by executing this form and sending a copy to their attorney-in-fact (as well as any institutions that may have the original POA on file).

Revocation of Power of Attorney – When a principal feels it’s time to end the conveyance of authority, they can cancel it by executing this form and sending a copy to their attorney-in-fact (as well as any institutions that may have the original POA on file).

Download: PDF, Word (.docx)

Signing Requirements: Must be signed by the principal (§ 30-5-10-1(a)(2)).

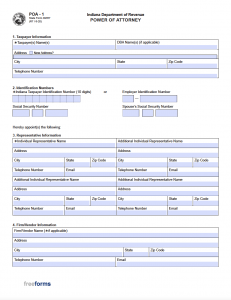

Tax Power of Attorney – People who wish to appoint an accountant, tax attorney, or another type of agent to represent them for tax purposes can complete a copy of this form.

Tax Power of Attorney – People who wish to appoint an accountant, tax attorney, or another type of agent to represent them for tax purposes can complete a copy of this form.

Download: PDF

Signing Requirements: Must be signed by the taxpayer (45 IAC 15-3-4(a)(5)).