By State

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

What is a Rent-to-Own Lease Agreement?

In order to answer this question, it is important that you first know the difference between the two (2) types of lease-to-own contracts, which are:

- Lease-Purchase – This contract requires the lessee to follow through with the acquisition of the property during the term of the occupancy.

- Lease-Option – This type of agreement merely gives the lessee the possibility of buying the property during the term, i.e. no obligation to purchase.

Now that you understand the distinction between the two types of contracts, it is important that you realize that the form available on this page is classified as a lease-option agreement. So to elaborate on the definition above, this agreement allows the lessee to occupy the space as a tenant while simultaneously supplying them with the right of first refusal.

How Does a Rent-to-Own Lease Agreement Work?

Whether you are an owner of a residence or just an individual looking for a place to call home, a rent-to-own lease agreement may be something that you might want to consider. Follow the steps below to better understand the process that is involved with this type of contract.

Step 1 – Determining If This Contract Is Right for You

Many people are already aware of their preference to either rent or buy a home, so why would a landlord/seller or tenant/buyer decide to carry out this type of arrangement? Well, the fact of the matter is that it could be beneficial to either side depending on the scenario. Here are some advantages connected to the rent-to-own lease agreement:

For Tenants/Buyers:

- More Time to Obtain Financing – Homebuyers who would like to purchase a specific property but need more time to acquire the proper financing can enter into this type of agreement in order to protect the home from being purchased by another party.

- Trial Run – If an individual is thinking about buying a certain home but they are conflicted as to whether or not they will like it in long run, they can suggest a rent-to-own tenancy where they would be able to test it out before committing to a sale.

- Building Equity – Users of the rent-to-own lease agreement may specify within the contract that a certain portion of the rent payments shall go towards the acquisition of the home. Depending on the term of the lease, the tenant/buyer may have a significant percentage of the down payment paid off by the time they decide to purchase the residence.

For Landlords/Sellers:

- Consideration for the Option – Typically, with this type of contract, the lessee will be required to pay a considerable upfront deposit in order to gain the privilege to purchase the dwelling.

- Rent Payments – During the time of the lessee’s occupancy, the lessor will be entitled to monthly payments. So, instead of the property remaining stagnant on the market, they will be receiving compensation until the lessee decides to purchase the home.

- Higher Purchase Price – The homeowner may be able to procure a greater purchase price as the lessee has to make an enticing offer in order to obtain the exclusive option to purchase.

- Attract More Buyers – When the economy is in a little bit of a slump and the seller is not receiving many offers, they may draw in more potential buyers if they can offer this kind of structure.

Step 2 – Offering the Rent-to-Own Lease Agreement

This contract will usually need to be presented as an option by whichever party desires its use. Since it is not as commonly used as a regular lease or purchase agreement, you will have to negotiate with the opposition and demonstrate to them some of the previously-mentioned benefits in order to get them on board.

Step 3 – Negotiating the Terms of the Contract

If both parties are interested in carrying out this type of arrangement, then they may proceed by deliberating over what conditions will be associated with the contract. The participants should come to a conclusion on the following components of the lease:

- Option Term – This would be the period of time that the lessee has the right to occupy the premises and purchase the home. After the expiration of this date, the lessee can no longer reside within the dwelling and they forfeit their exclusive right to buy the residence.

- Monthly Rent – The amount of money that is owed each month for the use of the property.

- Security Deposit – Funds required to be deposited by the tenant/buyer prior to their occupancy in case they cause any damage to the property or fail to make any necessary payments.

- Cost of Utilities & Services – The individuals partaking in the transaction should indicate who is responsible for which utilities/services associated with the dwelling.

- Option Consideration – One of the distinct elements of the rent-to-own lease agreement, this is the sum of money deposited by the lessee in order to reserve the option to buy the home. This may go towards the down payment if the lessee decides to purchase the property. If they decide not to acquire the residence, then the lessor may be entitled to the full amount of the deposit. (This price can vary from 1-5% of the total purchase price.)

- Purchase Price – The figure agreed upon by both parties concerning the procurement of the home.

Step 4 – Signing the Document

Following the establishment of the terms and recording them within the form, the participating parties should finalize the contract by furnishing it with:

- Landlord(s)/Seller(s) Signature(s)

- Tenant(s)/Buyer(s) Signatures(s)

- Agent(s) Signature(s) (if applicable)

- Witness(es) Signature(s) (recommended)

Step 5 – Using the Option to Purchase

After the commencement date of the contract, the lessee may employ the option to purchase at any point during the course of the tenancy. Should they decide to carry out this action, they will have to:

- Notify the Landlord/Seller – The lessee must provide the lessor with written notice of their intent to purchase (must specify a valid closing date).

- Fund the Purchase – They must be able to acquire the necessary financing to fund the acquisition (it is recommended that the parties include a contingency within the purchase agreement that stipulates that the contract is terminated if the buyer cannot finance the sale).

- Execute a Purchase Agreement – In addition to the obligations made within the lease agreement, the parties are also compelled to carry out a purchase agreement for the purpose of further establishing the conditions surrounding the sale.

Frequently Asked Questions (FAQ)

Where Can I Find / Advertise Rent-to-Own Listings?

Most folks who have their home on the market, whether they are trying to rent it out or sell it, will usually not offer the rent-to-own option. This is something that will typically have to be proposed by the party who wishes to carry out this type of contract. With that being said, there are a few select websites that cater to rent-to-own properties, these being:

Can a Landlord Break a Rent-to-Own Contract?

Lessees who enter into a lease-option agreement may fear that the lessor will sell the property to another party if they receive a better offer during the course of the tenancy. Luckily for the tenant, the landlord is legally required to uphold the terms & conditions made within the contract. Although, in some cases, the lessor may try to bypass the obligations of the lease-option in order to get a better price for the property. In this instance, the lessee will have to take the violating party to court to protect the arrangement. As long as the agreement is valid, the lessee should have no problem winning the suit.

What Are the Cons of a Rent-to-Own Lease Agreement?

As we already mentioned the pros of this contract in the steps above, it is also important to know the possible disadvantages related to this document. Users should consider the following cons:

For Tenants/Buyers:

- Non-Refundable Deposit – In order to achieve this type of transaction, the lessee will customarily be obliged to offer a monetary sum for the option to purchase the home. This will usually go towards the down payment if they decide to buy the property. But, if they decide they do not want to acquire the dwelling, then they will usually take a loss on the amount of the deposit.

- Higher Rent – It is not uncommon for the lessee to pay higher rent in comparison to the current market rate. This is because the seller of the home has more leverage in their requests as they will want the best deal possible before granting this type of arrangement.

- Maximum Purchase Price – Similar to the matter of rent, a landlord/seller who is not in a desperate situation can demand a greater amount for the purchase price in order for them to accept the increased risk attached to this form of tenancy.

- Financing – Lessees who use this agreement for the purpose of gaining more time to secure the necessary financing may incur serious losses if they are unable to meet the standards of the lender before the expiration of the contract. (An example of this would be a lessee who has poor credit and intends on increasing their score but fails to do so within the allotted timeframe and loses the initial deposit.)

For Landlords/Sellers:

- Risk of Non-Payment – The majority of landlords/sellers getting involved in a rent-to-own contract will rely on the payments they receive to continue paying their mortgage for the property. If the lessee ends up in a predicament where they cannot pay the rent, the owner may have to take over the costs of the original property on top of the expenses associated with their new living arrangement.

- Appreciation – A lessor who agreed to a certain sales price at the time of signing the lease-option agreement may suffer losses if the property substantially increases in value by the time the lessee carries out their right to purchase the home.

- Depreciation – If the property diminishes in value from the commencement date of the contract and the lessee decides not to procure the home, then the owner will take a hit on what they could have made when the market was offering a greater price for the residence.

- Higher Offer – If the seller receives a higher bid from another individual during the term of the lease-option, they are not allowed to accept it as they are tied to the conditions of the current contract.

- Uncertainty – Lessors taking part in a rent-to-own lease agreement must be aware of the overall uncertainty surrounding the arrangement. The tenant always has the option to not follow through with the purchase, so you should not partake in this type of transaction if you are counting on a sale within a specific timeframe.

How Do You Calculate Rent-to-Own Payments?

One of the main reasons a lot of folks avoid the rent-to-own configuration is that they are uncertain of how to determine what the costs should be for the available property. If you are a landlord/seller, you are going to want to secure a rent that covers all your property expenses, adequate compensation for the option to purchase, and a sales price that reflects the fair market value. In order to get an idea of what you should charge, you should take the following factors into account:

- Current Position – Are you getting involved in this type of contract because you think it would be profitable, or because the property hasn’t made any progress on the market and you need to make concessions? The amount of money that you are able to demand will depend heavily on the answer to this question.

- Option Term – How long will the tenant occupy the premises and retain the right to purchase the dwelling?

- Property Value – The rental payments and purchase price should be based on the fair market value of the property. If you are dealing with a tenant/buyer that is set on renting-to-own your property, you should aim for a greater selling price.

- Mortgage Balance – Take into account the sum of money needed to pay off the existing loan.

- Interest Rate – What is the current interest rate? This figure is important to take into consideration when calculating the cost of a rent-to-own property.

- Monthly Payments – How much do you pay for the mortgage’s monthly installments? It is key that this is covered by the amount you charge the lessee each billing cycle.

- Property Taxes – Breakdown the amount you pay each month in property taxes.

- Insurance – Try to incorporate the monthly cost of homeowners’ insurance into the payments.

Upon the accumulation of all these figures (as well as any other monthly expenses), you should be able to calculate the costs associated with the contract. (The Mortgage Professor offers an online tool called the “Lease to Own Calculator” that can help home sellers compute what they should be charging for the tenancy.)

Should I Have an Inspection Conducted?

Any individuals interested in renting-to-own a particular property should consider hiring the services of a professional to conduct a thorough investigation of the premises to make sure that the dwelling has no significant adverse defects. Since the lessee is not obligated to buy the home with this type of contract, participants can alternatively implement the move-in/move-out checklist for the purpose of noting any damages before and after the tenancy (should the tenant not go through with the acquisition).

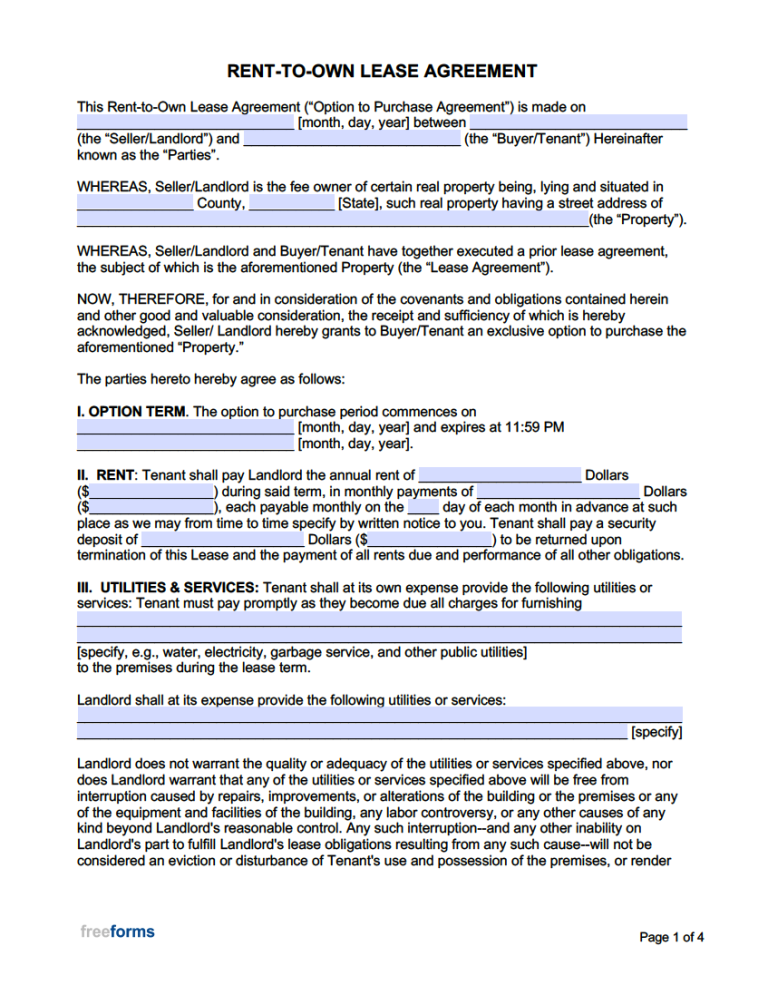

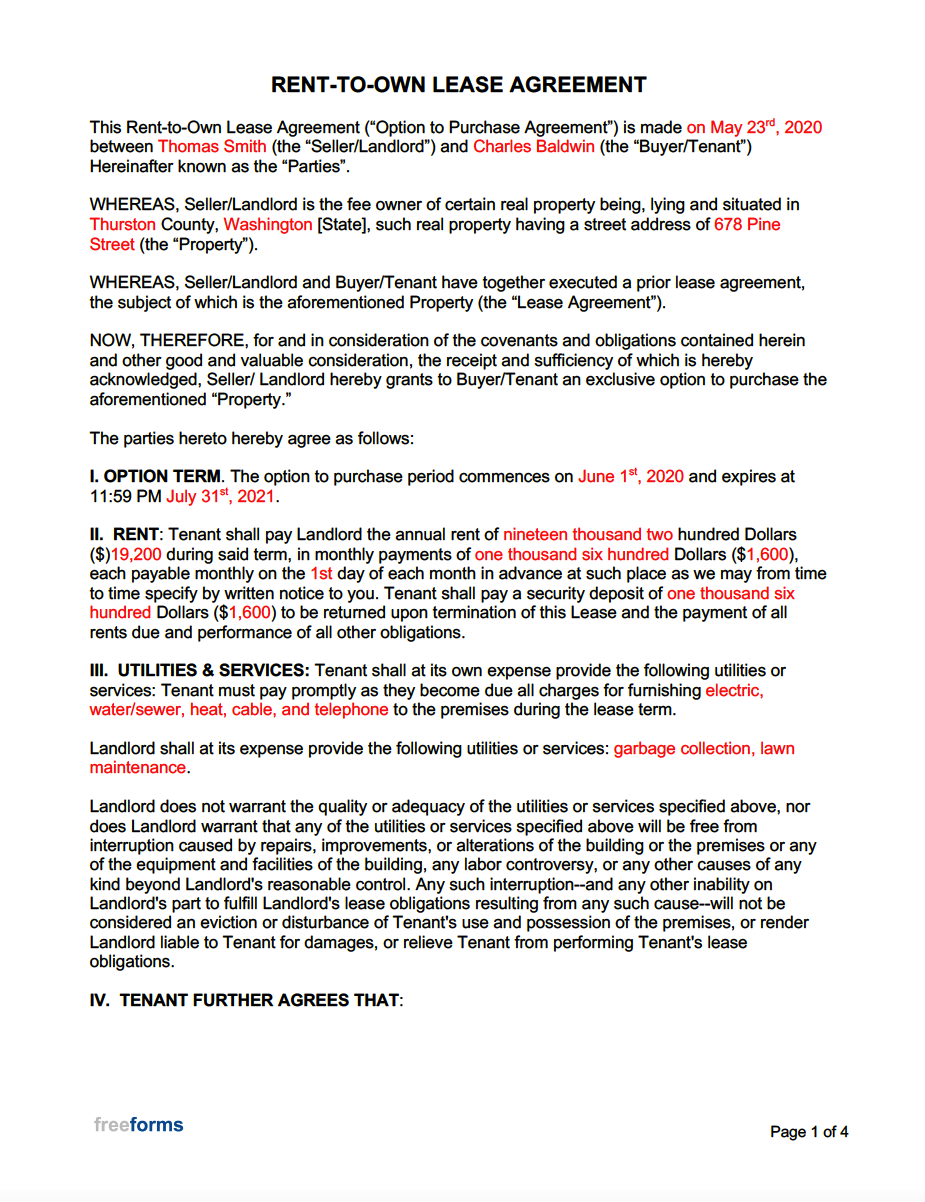

Sample Rent to Own Lease Agreement

Download: Adobe PDF, MS Word (.docx)