Laws

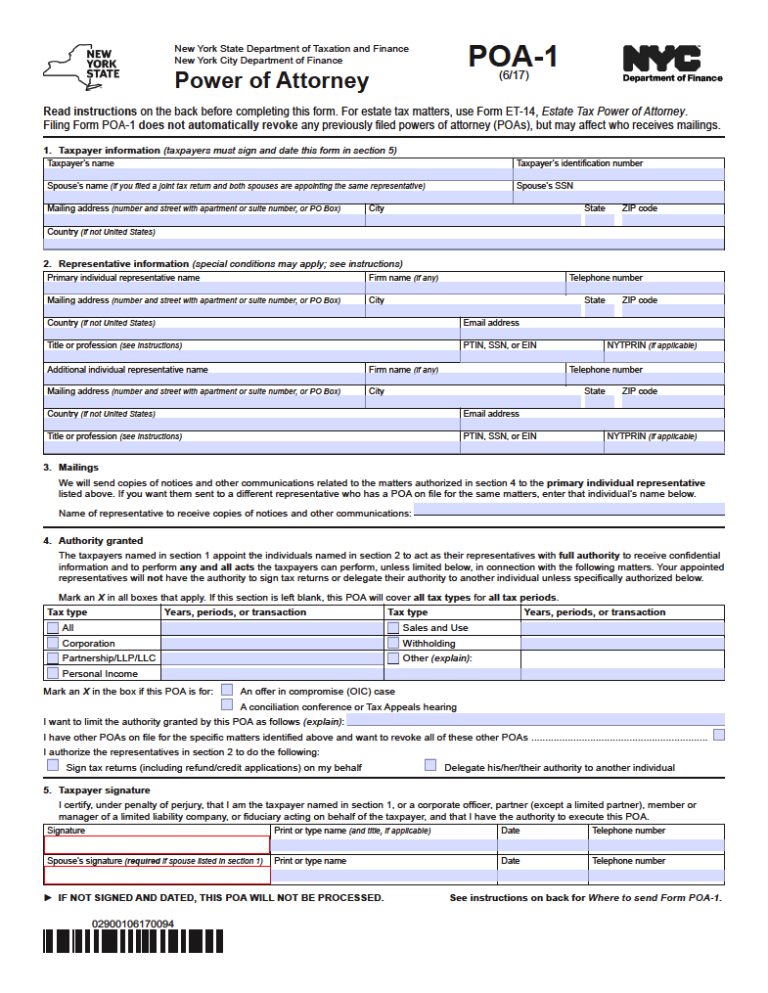

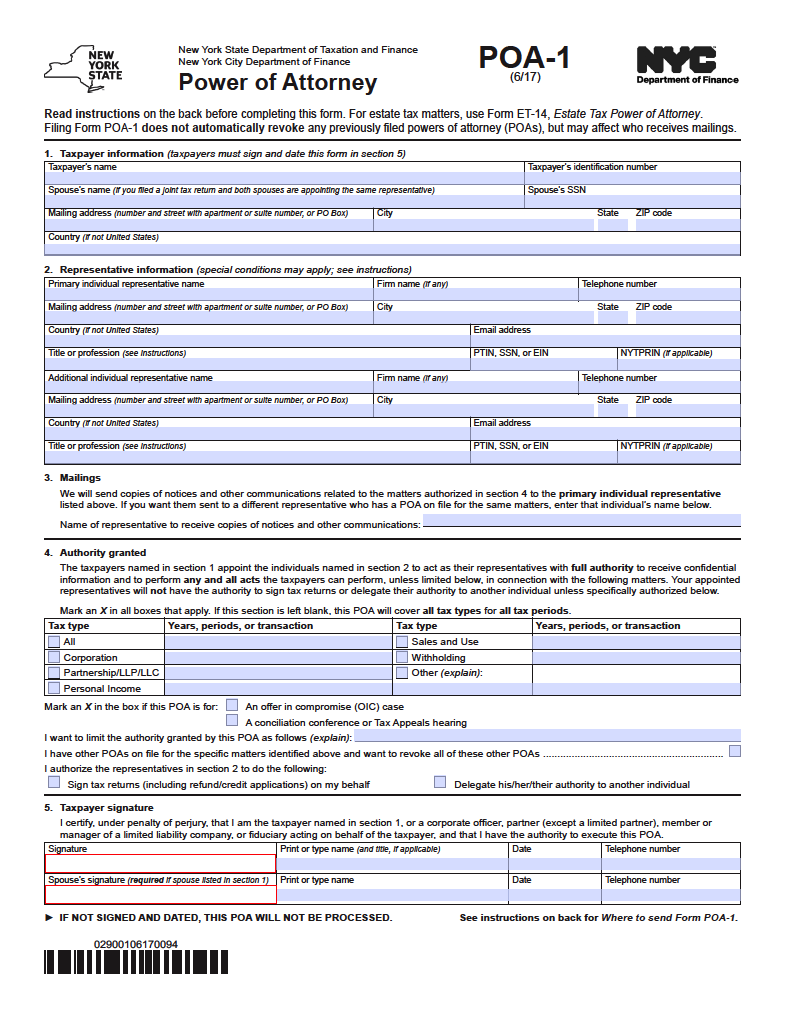

Signing Requirements – Taxpayer(s) signatures will need to be provided in the designated space(s) as directed within the form.

How to File

Once the document undergoes proper finalization, it can be filed with the New York State Department of Taxation and Finance. Filing can be carried out by creating an account to take advantage of NYSDTF’s Online Services System or by utilizing one of the following methods of delivery:

By Mail:

NYS Tax Department

POA Central Unit

W A Harriman Campus

Albany, NY 12227-0864

OR

By Fax:

POA-1/All Other Forms:(518) 435-8617

Estate Tax Forms: (518) 435-8406

Once sent in, the average processing time is (1) business day for online submission, two to three (2-3) business days for fax submission, and seven to ten (7-10) business days for submission by mail.

Other Versions

Tax Power of Attorney (Form POA-1) (Previous Edition)

Download: Adobe PDF

Instructions: Adobe PDF

Additional Resources

- Law Help NY – Power of Attorney FAQs

- NY State Department of Taxation and Finance – E-Z Rep Form TR-2000, Tax Information Access and Transaction Authorization Info

- NY State Department of Taxation and Finance – Power of Attorney and Other Authorizations

Related Forms (5)

- Durable (Financial) Power of Attorney

- NYC Tax Power of Attorney

- Estate Tax Power of Attorney

- E-ZRep Tax Form

- Revocation of Power of Attorney

Durable (Financial) Power of Attorney

Durable (Financial) Power of Attorney

Download: Adobe PDF, MS Word (.docx)

New York City Tax Power of Attorney (Form POA-2)

Download: Adobe PDF

Instructions: Adobe PDF

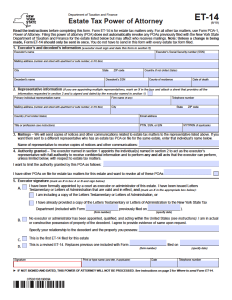

NY State Tax Power of Attorney (Form ET-14)

Download: Adobe PDF

Instructions: Adobe PDF

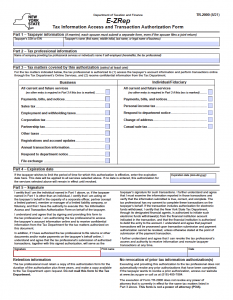

NY State E-ZRep Tax Info Access (Form TR-2000)

Download: Adobe PDF

Information: Adobe PDF

Revocation of Power of Attorney

Revocation of Power of Attorney

Download: Adobe PDF, MS Word (.docx)