An Alabama LLC Operating Agreement constructs a framework to institute a detailed account of how a company will be managed. Factors such as ownership interest, distributions, and initial contributions can be recorded within the form to confirm documented understanding between owning parties. The filing also summarizes the intent for the procedure regarding operations, rights, and responsibilities for each owing member to verify upon the form’s execution. The state of Alabama does not require official submission of the agreement to successfully form an LLC, although it is recommended to ensure that the interests of all listed members are legally secured.

Laws

LLC Statutes – Code of Alabama – Alabama Limited Liability Company Law (§ 10A-5A-1.01 – 10A-5A-12.05)

Operating Agreements – Limited Liability Company Agreements – Scope; function; and limitations (§ 10A-5A-1.08)

Definitions – “Limited Liability Company Agreement” means any agreement (whether referred to as a limited liability company agreement, operating agreement, or otherwise), written, oral, or implied, of the member or members as to the activities and affairs of a limited liability company or series thereof. The limited liability company agreement of a limited liability company having only one member shall not be unenforceable by reason of there being only one person who is a party to the limited liability company agreement. The limited liability company agreement includes any amendments to the limited liability company agreement (§ 10A-5A-1.02(l)).

Formation – § 10A-5A-2.01

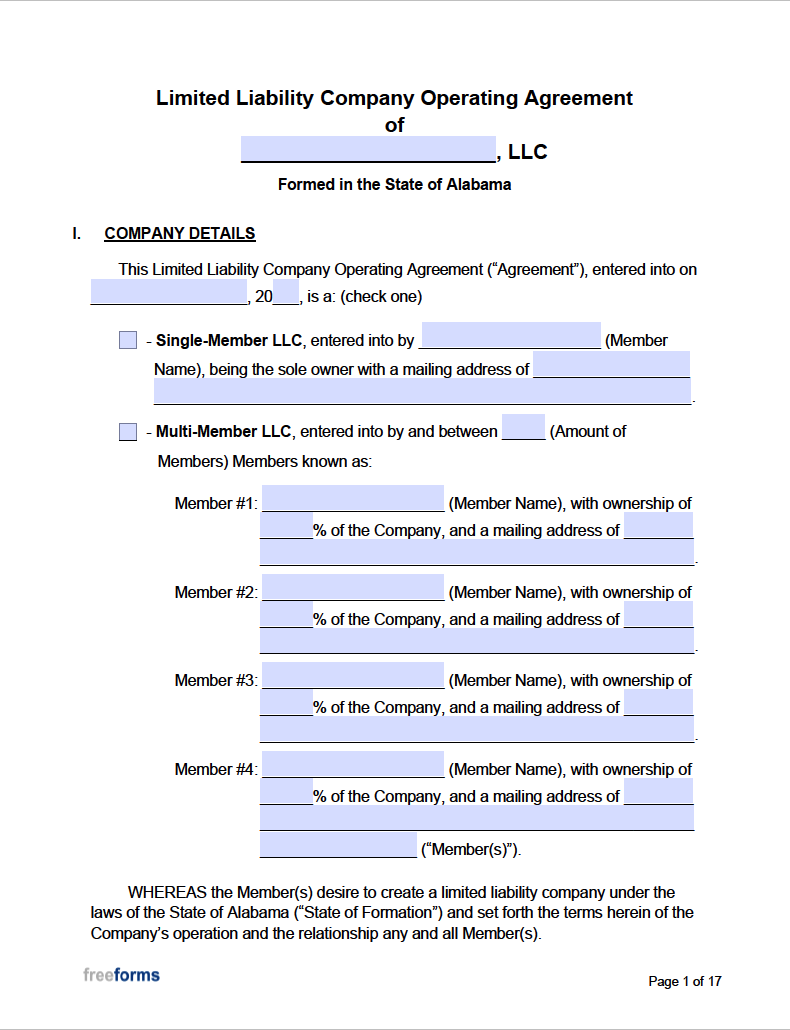

By Type (2)

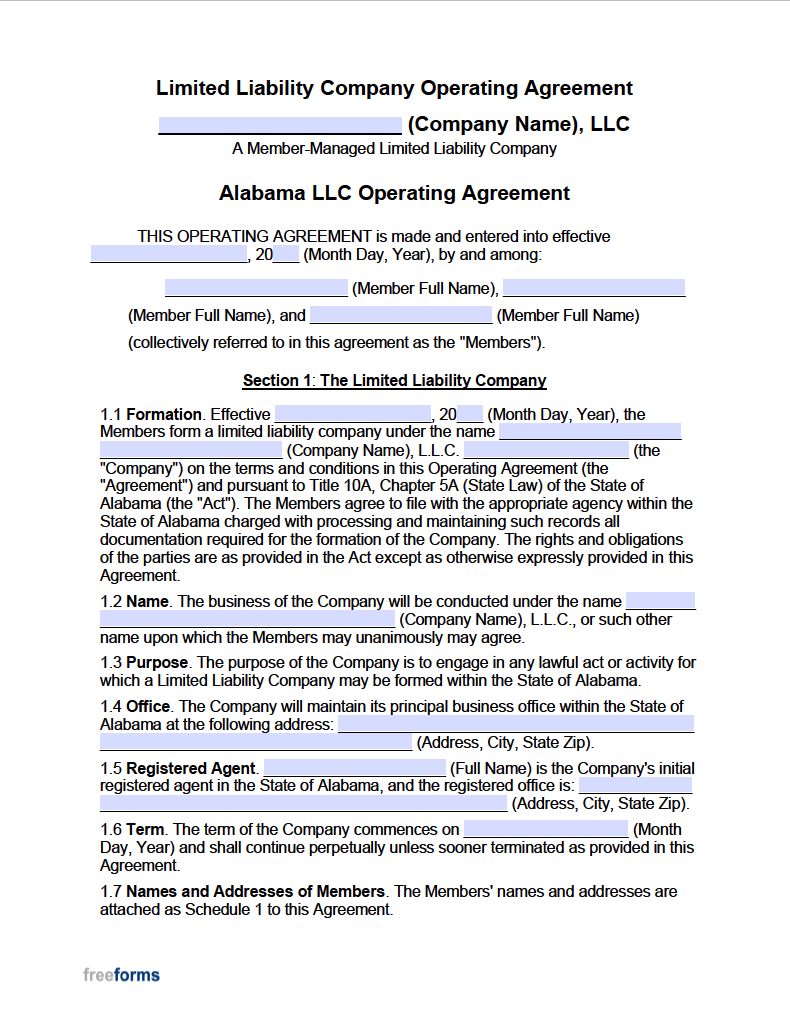

Multi-Member LLC Operating Agreement – Authorizes operating policies for LLCs consisting of 2 (two) or more members.

Multi-Member LLC Operating Agreement – Authorizes operating policies for LLCs consisting of 2 (two) or more members.

Download: Adobe PDF, MS Word (.docx)

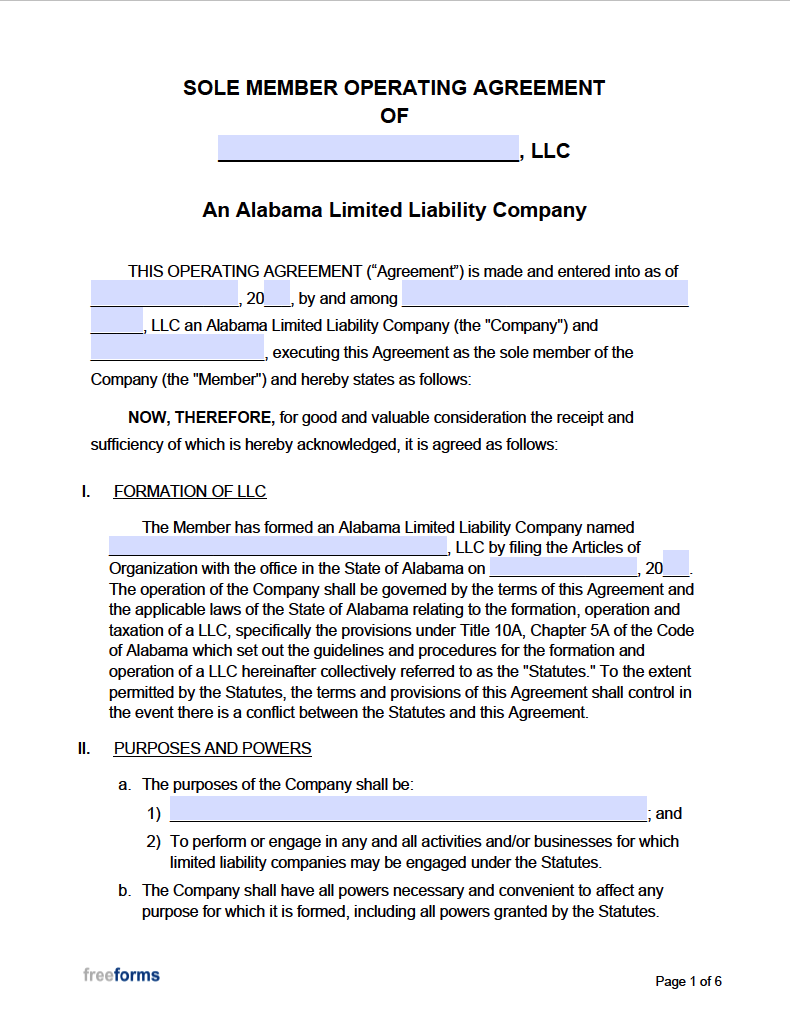

Single-Member LLC Operating Agreement – Defines the parameters of how a company will be run when there is only one owning individual.

Single-Member LLC Operating Agreement – Defines the parameters of how a company will be run when there is only one owning individual.

Download: Adobe PDF, MS Word (.docx)

Create an LLC in Alabama (5 Steps)

Forming a limited liability company can be an ideal selection when structuring a newly-founded business. Establishing a company as an LLC, compared to a partnership or sole proprietorship, serves to designate the business as a separate entity from the owning party or owning parties. This separation can offer additional liability protection for interest holders and favorable options for handling the company’s taxes. The instructions listed below can assist in effectively initiating the origination of an LLC in the state of Alabama.

- Step 1 – Reserve a Name for Your Company

- Step 2 – Elect a Registered Agent

- Step 3 – Apply for a Certificate of Formation

- Step 4 – Generate an Operating Agreement

- Step 5 – Complete Remaining Tasks Relevent to the Business

Step 1 – Reserve a Name for Your Company

The initial measures to take in forming an LLC is choosing and registering a name for your company. After selecting a name for your LLC, make sure to cross-reference it within the Alabama Secretary of State Business Entity Database to confirm that the name is available and not actively in use by another company. Every limited liability company name is also required by state law to include “LLC” or “L.L.C.” within the designated business name (§ 10A-1-5.06).

Upon narrowing down a satisfactory name for your LLC, a Name Reservation Request can be filed either by mail or online:

- Online – The Secretary of State’s Online Services Portal can be utilized to complete and submit the name reservation request as directed for both domestic and foreign entities.

-

- Fees: Demanded payments for name reservations are $27 for subscribers (for ACH account transactions) or $28 for non-subscribers (credit card transactions).

- Mail – First, download the appropriate Name Reservation Request Form:

After acquiring the application, fill it out accordingly and execute as needed, and then it can be sent to the following address:

Secretary of State

Business Services

PO Box 5616

Montgomery, AL 36103

-

- Fees: All forms must be supplemented by a state-mandated payment of $25 (Accepted payment methods include credit card, check, or money order).

Step 2 – Elect a Registered Agent

Alabama law states that a prerequisite to founding an LLC is to assign an individual to represent the company as a Registered Agent. The function of a registered agent is to confirm the identity of a designated person or business entity to receive communications on behalf of the LLC should an important tax or legal document be delivered. The nominated agent can be an owner/member of the LLC, a friend, family, or a hired professional. An agent is required to be:

- Available during typical business hours

- At least eighteen (18) years of age

- An Alabama resident with an in-state mailing address

A commercial agency can also be commissioned to represent your LLC, as long as the business is certified to conduct business within Alabama. Review the Secretary of State’s compiled list of registered agents for further information.

Step 3 – Apply for Certificate of Formation

Next, the government paperwork associated with forming an LLC must be appropriately completed and returned to the Alabama Secretary of State for processing and approval. Accomplishing this portion of the filing obligations can be carried out using the SOS’s website or via physical mail as described below:

- Online – Visit the Secretary of State’s Online Services Portal to continue with the fillable electronic application according to the prompted queries.

-

- Fees: The total cost for Domestic LLC submissions come to $208. This amount includes a $100 fee for the SOS, a $100 fee for your county of residence, and an $8 handling fee. Foreign LLC filings require an aggregate amount of $156 in fees, comprised of $150 for the SOS and a $6 processing fee.

- Mail – To file by mail, select a link available below to download or print the corresponding document regarding the type of LLC you wish to form (domestic or foreign):

When all the demanded information and necessary endorsements have been captured within the form, it can be prepared for delivery to the Alabama SOS. Make sure to provide a second copy of the application to include in the mailing packet, along with all stipulated fees, and a self-addressed stamped return envelope to:

Secretary of State

Business Services

PO Box 5616

Montgomery, AL 36103

-

- Fees: Domestic LLC Certificates of Formation must be accompanied by a $200 payment to the Secretary of State. Those submitting Foreign LLC Applications for Registration will need to supply the SOS with a monetary remittance of $150 to institute the company’s formal origination (Both domestic and foreign fee requirements can be paid in the form of a check, money order, or credit card authorization).

Step 4 – Generate an Operating Agreement

While the Alabama legislature does not officially compel those who form an LLC to produce an implemented operating agreement, it is advised to formulate a written understanding to define multiple factors affecting ownership, distribution of income, and company management. Although notarization of the document is not mandatory, it is highly suggested to certify the arranged commitment.

Step 5 – Complete Remaining Tasks Relevent to the Business

After forming the company and filing all necessary paperwork with the state, there are still a number of performances to be completed to keep your LLC compliant with state and federal regulations. There may also be additional filings to secure and upkeep procedures to maintain depending on the nature of the particular type of business. Make sure to follow through with the tasks below that apply to the unique needs of your LLC.

- Acquire a Federal Employer Identification Number (FEIN/EIN)

The Internal Revenue Service (IRS) employs a distinguishing nine-digit number connected with business entities to identify each company regarding their respective tax affairs. Although it is not required to obtain for every LLC, it is necessary to apply for loans, open bank accounts, or hire employees through the company. Application is free and can be issued online by going to the official IRS website to fill out the electronic form using the Online EIN Assistant Service.

Businesses that wish to apply by mail or fax can begin by downloading the Application for Employer Identification Number (Form SS-4). The IRS website provides a chart of addresses and phone numbers specifying where to send the paperwork according to residency circumstances. Upon approval, which can take an estimated 4-8 weeks, the IRS will send an EIN Confirmation Letter to the registered address for the LLC.

- File an Initial Business Privilege Tax Return

Once the LLC is created and recognized within the state of Alabama, the business will need to apply for an Alabama Entity ID Number with the Department of Revenue for tax purposes. Registering an LLC with the Alabama DOR can be carried out online with the aid of the My Alabama Taxes (MAT) Portal. Click on the link labeled “Register a business/Obtain a new tax account number” under the “Business” heading to begin the process.

After procuring a federal and state tax id number, the LLC will have all the necessary information to submit the first required state filing. Business officials have two and a half (2.5) months from the date of formation to file an Initial Business Privilege Tax Return with the Alabama DOR (§ 40-14A-29).

The document can be completed and delivered electronically utilizing the My Alabama Taxes (MAT) Portal as long as you have or want to create an account. If taxes are owed to the state, payments can be settled using the MAT Portal in the form of a credit card or ACH. Another option to submit the return is to send it directly to the DOR by mail. To utilize this preference, download the Initial Business Privilege Tax Return (Form BPT-IN), along with the instructions, enter the information associated with the LLC, and sign where indicated. If a payment is due, it must be remitted along with a finalized Business Privilege Taxpayer Voucher (Form BPT-V) and mailed to:

Alabama Department of Revenue

Business Privilege Tax Section

PO Box 327320

Montgomery, AL 36132-7320

- Obtain any Required Permits/Licenses

Various components will determine which permits and licenses a company will be obligated to attain to operate legally in Alabama. Industry-specific, tax, land use, and other particulars related to your LLC can all influence the type of license and permits that will be needed. The district, municipality, or county in which the business is located can dictate additional requirements depending on the regional legislature. Check the DOR’s website for information on business licensing, and contact your county probate office or licensing commission to inquire about any local permits or licenses you may need for your company.

Additional Resources

- Alabama Department of Revenue – Register an Entity

- Alabama Secretary of State – Business Entities Division Fees

- Alabama Secretary of State – LLC Information

- Internal Revenue Service – Employer ID Numbers