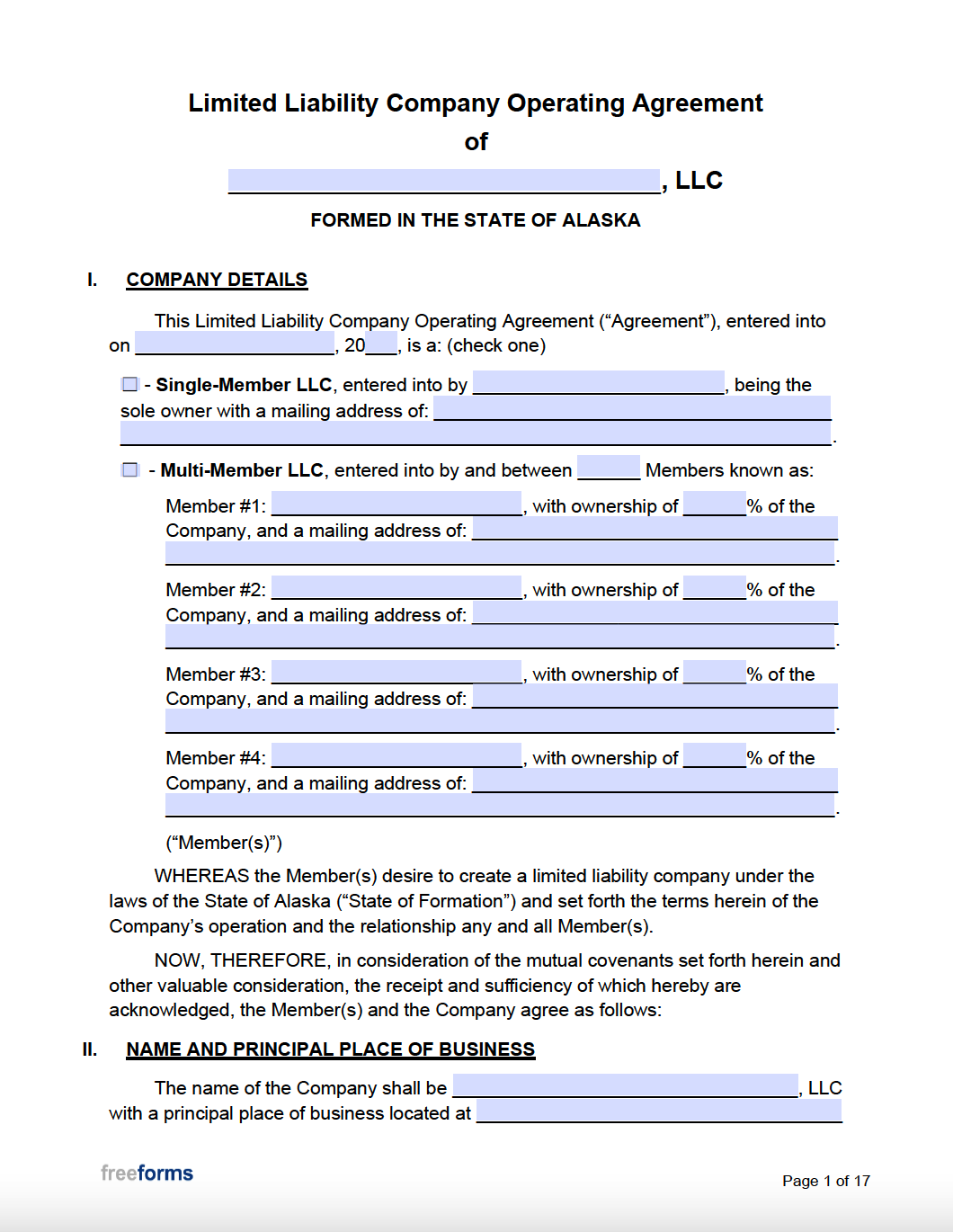

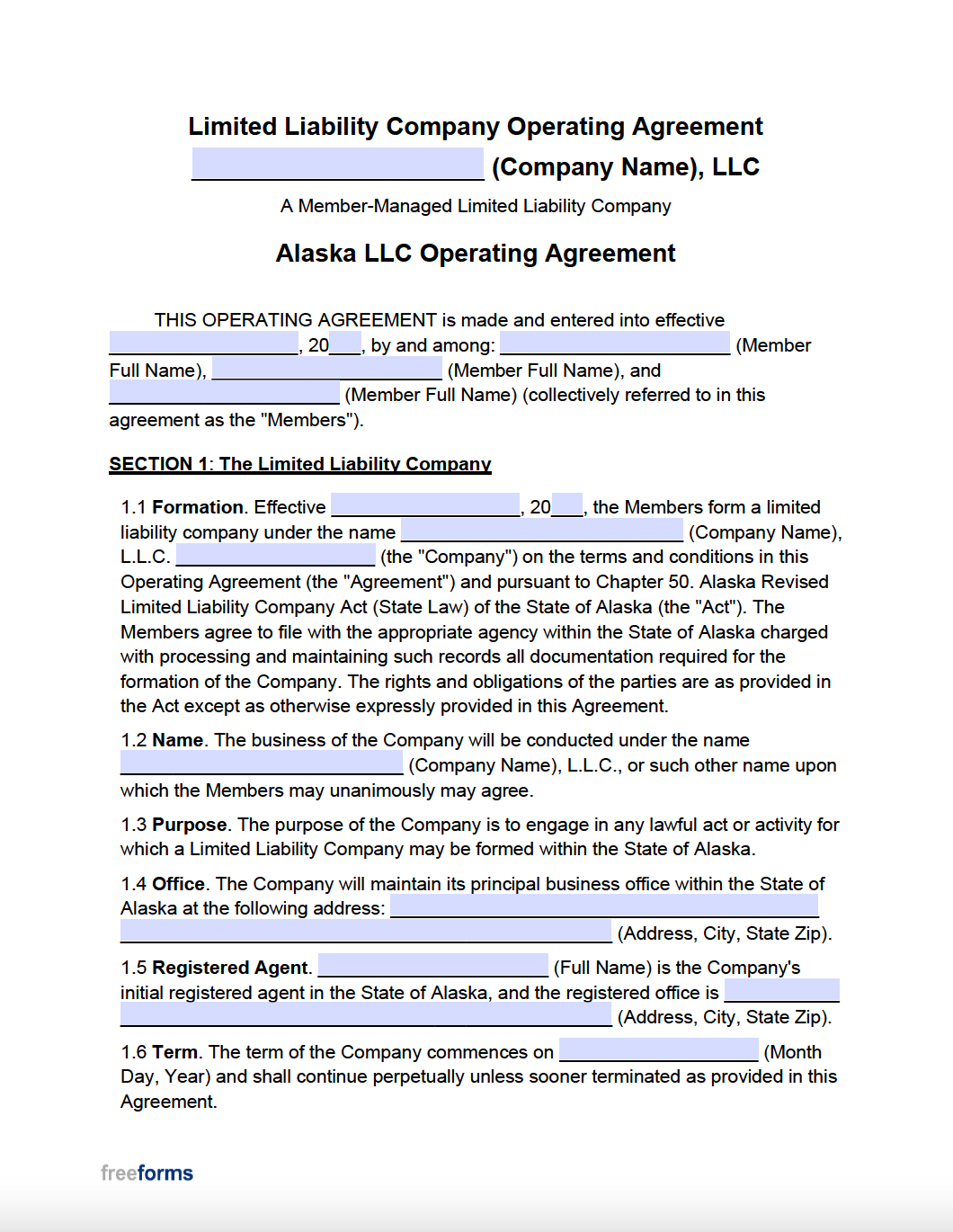

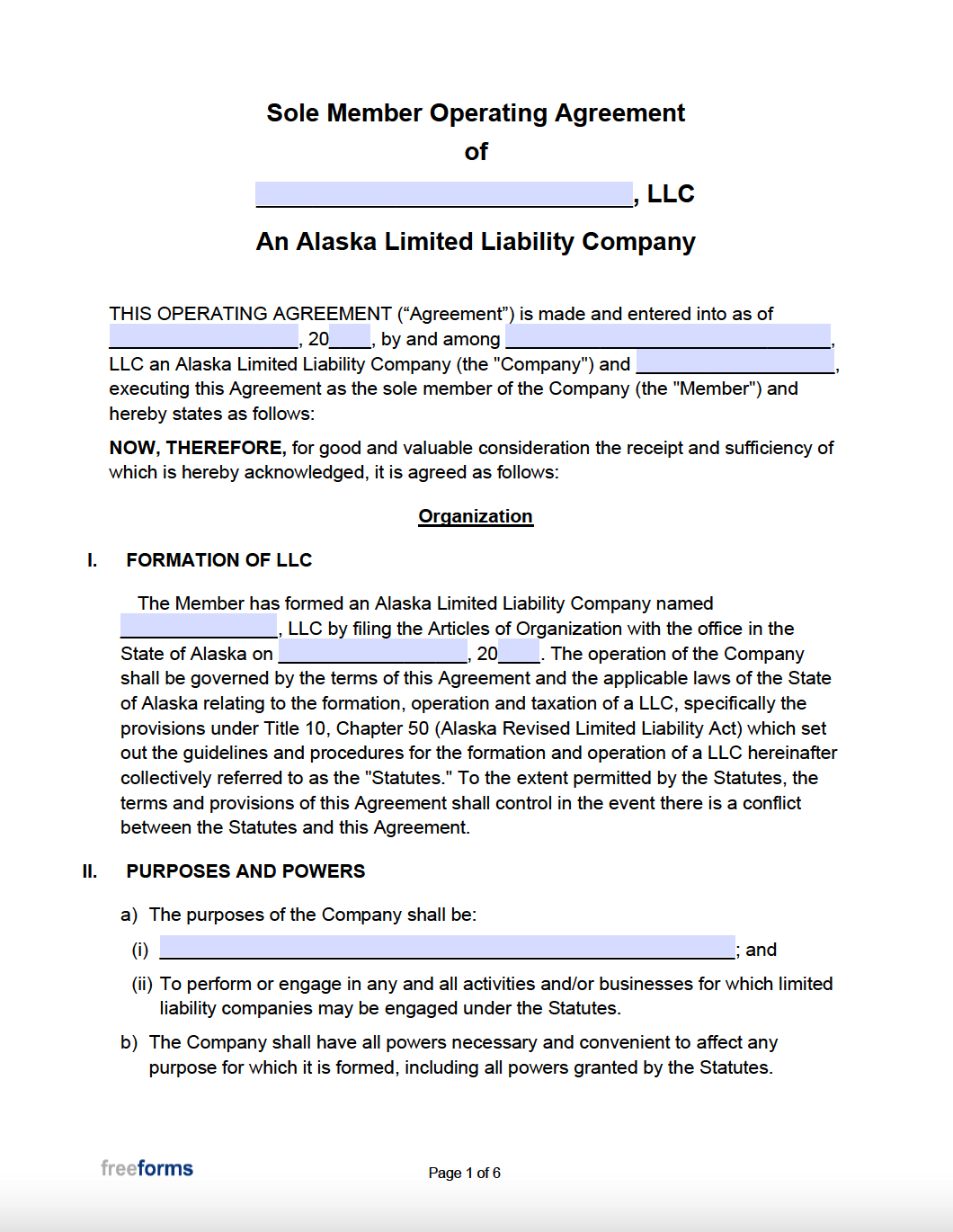

An Alaska LLC Operating Agreement devises a concrete account affirming the particulars concerning how a limited liability company will operate upon formation. A couple of essential functions of the filing are to confirm the amount of ownership interest that each member of the company possesses and record any initial contributions on an individual basis. Covered in the contract are a number of other sections that implement policies and procedures to reference in various situations, from the conducting of meetings to unforeseen events such as dissolution. Even though the state does not require LLCs to file an agreement to apply for legal formation, it can prove useful to present the document when seeking outside investment or bank loans.

Laws

LLC Statutes – Alaska Revised Limited Liability Company Act (§ 10.50.010 – 10.50.995)

Operating Agreements – § 10.50.095

Definitions – “Operating Agreement” means a written agreement among all of the members of a limited liability company about conducting the affairs of the company (§ 10.50.990(17)).

Formation – § 10.50.70 – 10.50.095

By Type (2)

Multi-Member LLC Operating Agreement – Documents the finer points regarding the operation of an LLC owned by more than one party.

Multi-Member LLC Operating Agreement – Documents the finer points regarding the operation of an LLC owned by more than one party.

Download: Adobe PDF, MS Word (.docx)

Single-Member LLC Operating Agreement – Confirms specific policies and procedures for how a company owned by one individual will be maintained.

Single-Member LLC Operating Agreement – Confirms specific policies and procedures for how a company owned by one individual will be maintained.

Download: Adobe PDF, MS Word (.docx)

Create an LLC in Alaska (5 Steps)

When a company wishes to do business as an LLC, a formal application must be made to document and institute the legal designation with Alaska’s Division of Corporations, Business, and Professional Licensing. Establishing a business entity as an LLC can be advantageous to associated interest holders because it essentially separates the business from the owner(s). The separation allows for beneficial tax classification opportunities and protection from personal liability for company matters. By following through with the detailed outline of requirements, a business can seek active status and be granted permission to operate as a limited liability company within the state.

- Step 1 – Determine a Bussiness Name for the LLC

- Step 2 – Designate a Registered Agent

- Step 3 – File Articles of Organization

- Step 4 – Assemble an Operating Agreement

- Step 5 – Perform All Other Necessary Tasks for the Business

Step 1 – Determine a Business Name for the LLC

Each business must have a designated business name unique from all other companies registered within the state. Once the desired name is selected, availability can be verified by searching the Alaska Corporations Database. Every LLC name must conform to Alaska state law, which states that it must include either “LLC”, “L.L.C.”, or “limited liability company” within the name (§ 10.50.020). The statute further stipulates that a name cannot contain the words “limited partnership”, “corp”, or wording that suggests that the company is a municipality, such as “borough” or “city”. After finding a suitable name that is not currently in use, an application for reservation can be submitted at the optional request of the founding party or parties to secure the name prior to LLC formation. The official name reservation process can be achieved in one of two methods:

- Online – For those that want to apply to reserve a business name online, complete the electronic form using the AK Division of Corporations’s Online Portal according to the provided instructions.

-

- Fees: A $25 fee must be paid in order to process the application. Payments can be issued with a credit or debit card by inputting the associated account information when prompted while completing the electronic form.

- Mail – Business name reservation applications can alternatively be submitted by mail. Download and complete the Business Name Reservation Application (Form 08-559) as directed, and provide payment details where indicated. The document can then be sealed in a stamped envelope and sent to:

State of Alaska Corporations Section

PO Box 110806

Juneau, AK 99811-0806

-

- Fees: Credit card information must be recorded within the document to cover the $25 cost for the name reservation.

Step 2 – Designate a Registered Agent

When setting up an LLC, the company is obligated to assign a registered agent to attend to any incoming communications related to the business. The nominated registered agent can be an individual or a company but must meet several requisites to be permitted the title (§ 10.50.055):

- Have availability during regular business hours

- Individual agents must be at least eighteen (18) years of age and a resident of Alaska

- Retain a physical address within the state of Alaska

- Be authorized to do business in Alaska (if an outside company)

Review the state’s web page dedicated to frequently asked questions about registered agents for more information on the topic.

Step 3 – File Articles of Organization

Next, to establish an LLC in an official capacity, the company must file with the Division of Corporations, Business, and Professional Licensing. The state of Alaska requests that applying businesses submit articles of organization to qualify for the classification of limited liability company. In addition to supplying company details, identification of the business type must be designated by indicating the corresponding North American Industry Classification System (NAICS) code. After obtaining all required information, filing can be fulfilled either online or by mail by following the provided instructions below:

- Online – Initiation of the formation of a domestic limited liability company can be attained by inputting the requested information using the Articles of Organization Application electronic form found on Alaska’s Division of Corporations website. Out-of-state companies that wish to conduct business as a foreign limited liability company in Alaska can apply by completing the official Certificate of Registration online form on the state’s website.

-

- Fees: Total fees due to successfully file a domestic LLC online are $250. Foreign LLC registrations will require a payment amount of $350 to be remitted upon submission of the application.

- Mail – Business owners that prefer to deliver the government docuemnt via physical mail can first download the form that matches the circumstances of the company (domestic or foreign LLC). Click on the provided link below to download the form that applies to your particular business situation:

The paperwork can then be completed and finalized by affixing signatures from all associated members. Both domestic and foreign applications can be printed and mailed to the following address:

By Mail:

State of Alaska Corporations Section

PO Box 110806

Juneau, AK 99811-0806

-

- Fees: Forms that are to be mailed in will require the same payment amount as online submissions. Domestic LLC formation fees come to a total of $250, while Foreign LLC registrations must be accompanied by a payment of $350.

Step 4 – Assemble an Operating Agreement

Upon forming an LLC, it is recommended that a contract be drawn up to institute a framework to regulate the connected variables regarding company operation. The presented operating agreement allows the founding members to set forth:

- Formation Information

- Owning Interest Percentages

- Member Contribution Amounts

- Distribution Procedures

- Company Meeting Protocols

- Designated Voting Rights

- Dissolution Policies

Alaska does not mandate that an operating agreement be presented when forming a limited liability company. Still, it is highly suggested to maintain a record of expectancies moving forward with the vast undertakings associated with the business. Utilize one of the following forms, depending on the ownership specifics of your LLC:

The form will need to be filled out and signed by all interest holders to become enforceable by state law. Copies can be made, distributed, and retained for reference and accountability purposes upon the document’s execution.

Step 5 – Perform Other Necessary Tasks for the Business

Following the formal process for the formation of an LLC, there can be additional obligations that need to be taken care of to ensure the company’s status remains intact regarding any regulatory state or federal requirements. Peruse the other tasks listed below to determine which supplemental performances may need to be fulfilled to keep your LLC active and authorized to do business.

- Obtain a Federal Employer Identification Number (FEIN/EIN)

The federal government offers the option for companies to be assigned a unique number by the Internal Revenue Service (IRS) that corresponds to the LLC. This employer identification number (EIN) is issued to assist in matters related to federal taxes and, although optional, may be required if the LLC plans on hiring employees or opening a business bank account. An EIN can be applied for online by visiting the IRS website and utilizing the Online EIN Assistant Service. Follow the on-screen prompts to complete and submit the requested information and signature electronically.

If a company prefers, the Application for Employer Identification Number (Form SS-4) can be downloaded, filled out, printed, and printed for submission by mail or fax. Once finalized, the paperwork can be sent via mail or fax to the address or number found on the IRS chart of addresses and phone numbers that aligns with your company’s circumstances regarding region and type (foreign or domestic). Acceptance and notice of confirmation and EIN assignment can take anywhere between 4-8 weeks and will be delivered by mail to the address on file for the LLC.

- File Initial and Biennial Reports

Once a company has received approval from the state confirming its formal LLC standing, the next step will be to file an initial report. From the official date of formation, a company is granted six (6) months to submit the online filing. The form can be filled out and submitted at no cost, utilizing the Initial Report online application. After providing an initial report to the Alaska Division of Corporations, subsequent biennial report filings will need to be completed every two (2) years (before January 2nd of the designated filing year) to keep the LLC active. The Biennial Report electronic form can be used to submit the requested information and the required $100 fee.

- Acquire Necessary Licenses/Permits

Any company that intends on doing business within the state needs to first obtain an Alaska business license (§ 43.70.020). An application can be fulfilled online, by mail, in person, or by fax depending on the preference of the company. Using the Online Business License Application page of Alaska’s Division of Corporation’s website can assist in the electronic submission of the and payment to process the request. Alternatively, businesses can elect to download the Business License and Endorsements New Application (Form 08-4181), complete it, and deliver it using one of the following methods:

By Mail/In-Person:

Business Licensing Section

PO Box 110806

Juneau, AK 99811-0806

OR

By Fax:

(907) 465-2974

-

- Fees: Forms that are to be mailed in will require the same payment amount as online submissions. Domestic LLC formation fees come to a total of $250, while Foreign LLC registrations must be accompanied by a payment of $350.

Some companies may be obligated to apply for other licenses depending on the specific type of business to be conducted. Check the Division of Corporations website to determine if your company needs to secure any additional professional licenses to operate in accordance with state regulations. Local ordinances regarding permits and licensing may also need to be addressed to ensure compliance with all city and district guidelines as well as state statutes.

Additional Resources

- Alaska Division of Corporations, Business, and Professional Licensing – Business Licensing

- Internal Revenue Service – Employer ID Numbers