Laws

LLC Statutes – Florida Statutes – Florida Revised Limited Liability Company Act (§ 605-0101 – 605-1108)

Operating Agreements – Limited Liability Company Agreements – Scope; function; and limitations (§ 605.0105)

Definitions – “Operating Agreement” means an agreement, whether referred to as an operating agreement or not, which may be oral, implied, in a record, or in any combination thereof, of the members of a limited liability company, including a sole member, concerning the matters described in section § 605.0105(1). The term includes the operating agreement as amended or restated (§ 605-0102(45)).

Formation – § 605.0201

By Type (2)

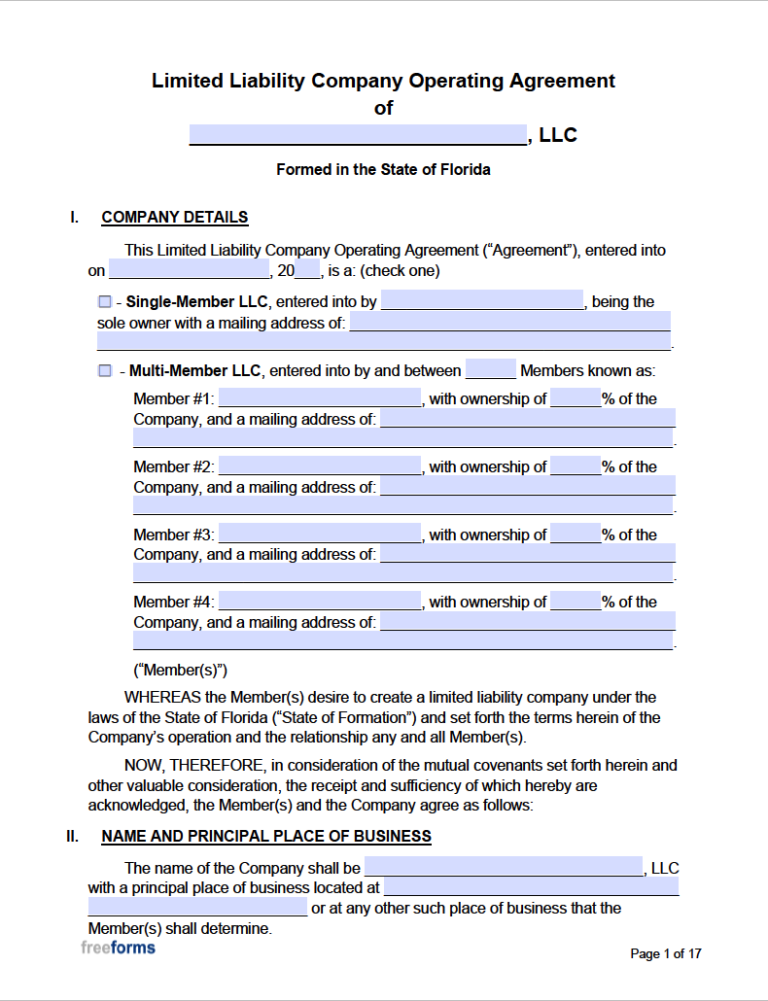

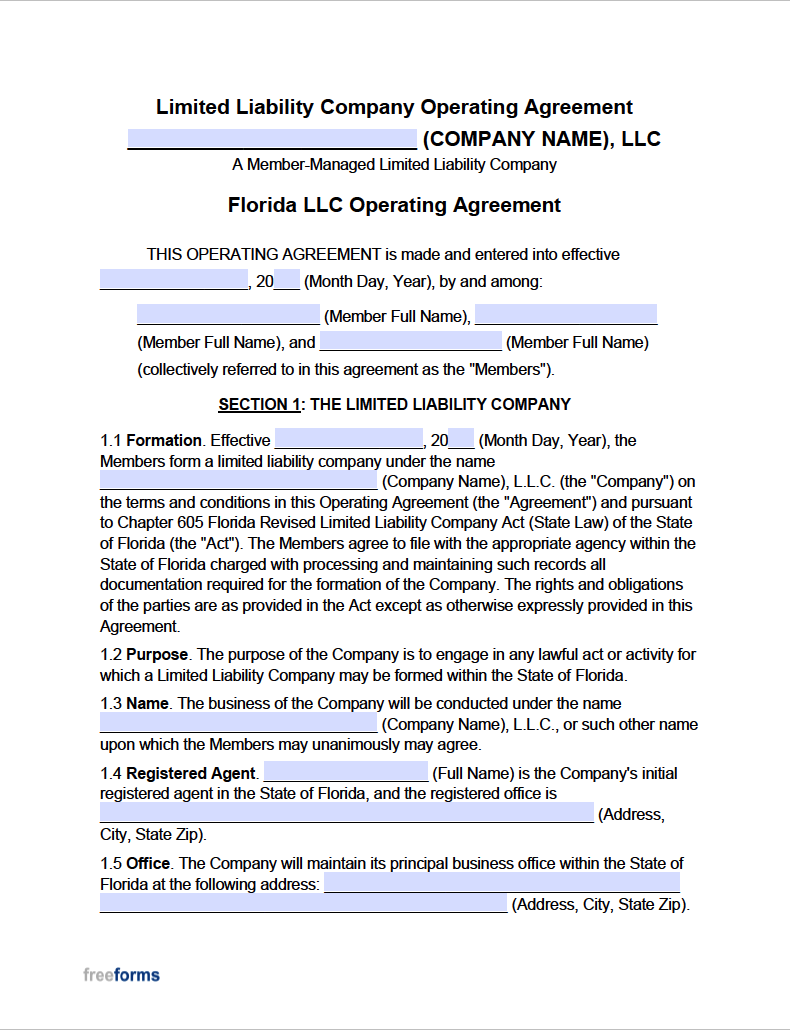

Multi-Member LLC Operating Agreement – Activates a lawful commitment concerning several aspects of an LLC owned by multiple members.

Multi-Member LLC Operating Agreement – Activates a lawful commitment concerning several aspects of an LLC owned by multiple members.

Download: Adobe PDF, MS Word (.docx)

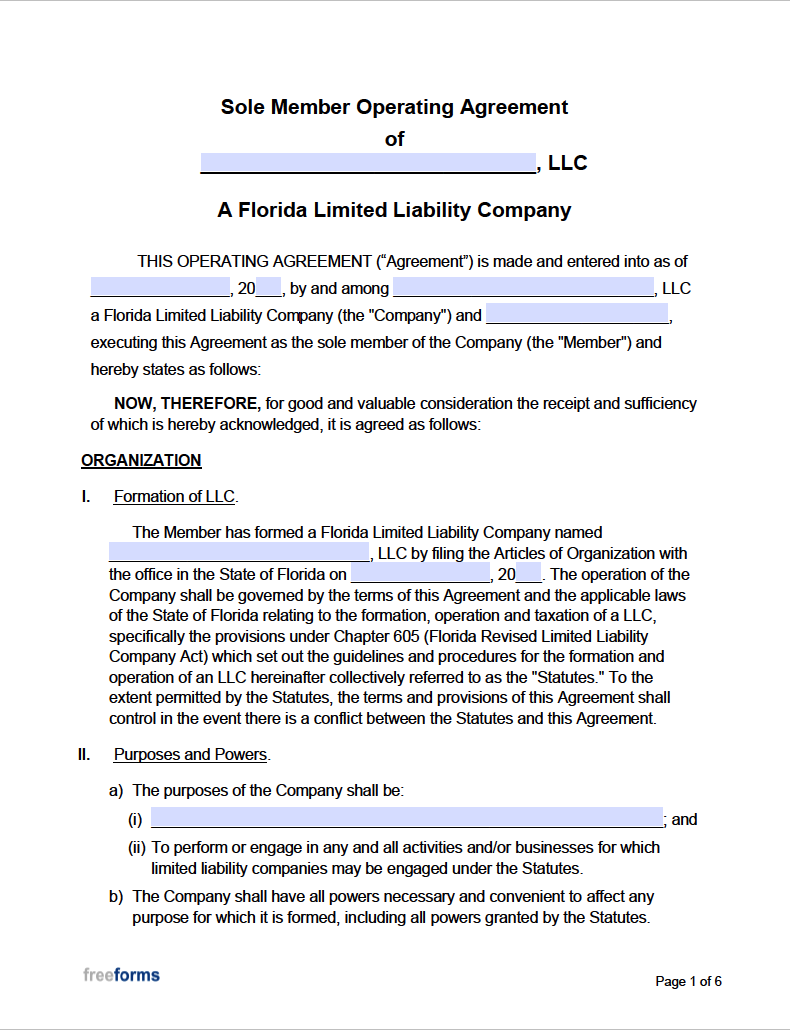

Single-Member LLC Operating Agreement – Creates documentation to map out the management of a limited liability company owned by only one person.

Single-Member LLC Operating Agreement – Creates documentation to map out the management of a limited liability company owned by only one person.

Download: Adobe PDF, MS Word (.docx)

Create an LLC in Florida (5 Steps)

To establish effective origination of a limited liability company in Florida, the founding party ( or parties) must complete various measures to comply with state regulations and gain active LLC status. Ensure to adhere to the steps listed below to form a Florida LLC correctly and legally.

- Step 1 – Register a Business Entity Name

- Step 2 – Assign a Registered Agent

- Step 3 – File Articles of Organization with the State

- Step 4 – Execute an LLC Operating Agreement

- Step 5 – Carry Out All Necessary Actions for the Company

Step 1 – Select a Business Entity Name

In preparation to apply for the formation of a new limited liability company, an entity name must be chosen prior to filing the necessary paperwork. To ensure the availability of a name, use Florida’s Division of Corporations website to search the state database. Enter the entity name or a keyword you wish to incorporate into your company’s name and click the “Search Now” button. Review the results to determine if a prospective business name can be registered for a new company. When researching the business entity database, make sure that the name you select conforms to the requirements per Florida Statutes § 605-0112. All business names must:

- Include the words “limited liability company”, or abbreviation “LLC”, or “L.L.C.”.

- Not contain any misleading language indicating “corporation”, “incorporation”, or any affiliation with the U.S. or Florida government.

- Be legally distinguishable from any actively registered business name according to FL Statutes § 605-0112(1)(b).

In addition to the official name of your business, LLCs can optionally secure what is known as a “fictitious name”. This alternate name can be procured for a company that plans to do business utilizing a name other than the one officially listed on the articles of organization. Currently registered fictitious names must also be verified for availability by using the Florida DOC Search Tool. Once a viable name is confirmed as a possibility, registration can be carried out electronically or through a postal or parcel service as directed below:

- Online – Visit the DOC’s Fictitious Name Registration Page for instructions to complete and submit the application.

-

- Fees: Upon online submission of the form, the required $50 payment can be issued by credit card, check, or money order.

- Mail – First, download the Application for Registration of Fictitious Name Form. After the paperwork is filled and signed, it can be sent, along with associated fees, to the listed address:

Fictitious Name Registration

PO Box 6327

Tallahassee, FL 32314-1300

-

- Fees: The applicant must include a check made payable to the “Florida Department of State” for $50, along with the completed paperwork.

Step 2 – Assign a Registered Agent

One requirement for new LLCs is that a responsible party be nominated to receive government filings, court documents, and other communications on behalf of the company. Should the business be involved in a legal matter, disclosure of any action has an assigned recipient to accept the notification. The agent can be an individual or an outside company but must meet specified criteria:

- At least eighteen (18) years of age

- Has a physical address located in the state of Florida (not a P.O. box)

- Available between regular business hours

Step 3 – File Articles of Organization with the State

After determining a registered agent and company name, a limited liability company can be formed by filing articles of organization with the state. The organization paperwork can be filed electronically (domestic LLCs only) with the Division of Corporations government website or delivered by mail or in-person as detailed below:

- Online – Domestic limited liability companies can elect to file online by employing the use of the Department of Corporation’s e-Filing Service. After clicking on the link to the page, follow the instruction to start a new filing. Upon completing the electronic form, payment information can be supplied to finalize the transaction.

-

- Fees: An amount totaling $125 is obligated to establish the filing. Accepted payment methods are credit card, debit card, or with an established Sunbiz e-File account.

- Mail/In-Person – Domestic LLCs that would like to submit a physical form can do so through the mail or by hand-delivering it to the appropriate location. Download the Articles of Organization for Florida Limited Liability Company Form and enter the requested information. Print the document and affix all required signatures where indicated. The form can then be submitted to one of the addresses provided below, dependent on the preference of the company owner:

By Mail:

New Filing Section

Division of Corporations

PO Box 6327

Tallahassee, FL 32314

OR

In-Person:

New Filing Section

The Center of Tallahassee

2415 N. Monroe Street, Suite 810

Tallahassee, FL 32303

-

- Fees: The application requires a payment of $125 by check made out to the “Florida Department of State”. Additional fees apply for certified copies ($30) and/or certificate of status ($5) for those that seek the option.

LLCs designated as foreign entities have a different process to successfully register within the state of Florida. Registration will require filing an application for the business to transact within the state. The Application by Foreign Limited Liability Company for Authorization to Transact Business in Florida Form can be downloaded, printed, and prepared as instructed. Once completed, the paperwork will need to be either sent or hand-delivered to:

By Mail:

Registration Section

Division of Corporations

PO Box 6327

Tallahassee, FL 32314

OR

In-Person:

Registration Section

Division of Corporations

The Center of Tallahassee

2415 N. Monroe Street, Suite 810

Tallahassee, FL 32303

- Fees: Mandatory registration fees are $125 and can be submitted in the form of a check made payable to the “Florida Department of State”.

Step 4 – Execute an LLC Operating Agreement

Creating a comprehensive written outline to clarify how each aspect of a company will be run is an intelligent decision for any LLC. Declarations can be recorded to set forth ownership interest percentages and detail initial member investment amounts. There are several provisions allowing members to denote rules and procedures regarding various elements of the business’s operation for legal and reference purposes. Separate forms are available for both companies owned by one party and companies with multiple members.

Step 5 – Carry Out All Other Necessary Actions for the Company

Forming an LLC with the state of Florida grants approval for the company to do business in the state. Several other acts must be performed as time goes on to ensure that the company is cleared to conduct business on the federal and state levels.

- Obtain a Federal Employer Identification Number (FEIN/EIN)

The federal government provides the option of attaining a designated number, allowing a company to file taxes with the Internal Revenue Service. The appointed number generated by the IRS is commonly referred to as a Federal Employer ID Number (FEIN or EIN). Not every LLC is obligated to acquire a number from the IRS, although it is typically necessary to furnish an EIN when seeking loans, licenses, and/or permits for a business.

To procure an EIN for an LLC, company members can visit the official government website to submit the electronic form with the aid of the IRS Online EIN Assistant. Alternatively, the application can be mailed or faxed to the IRS by first downloading or printing the Application for Employer Identification Number (Form SS-4). Once the document is obtained, it must be completed, signed, and submitted as indicated on the mailing address/fax number chart. After the IRS receives the form and acceptance is granted, allow 4-8 weeks for notice of approval by mail

- File an Annual Report

After LLC formation is certified, the business will need to file an annual report every year to maintain its active status. Annual reports need to be completed and filed online using the FL Division of Corporations website. Submission of the report requires a fee of $138.75 that can be issued by credit card, debit card, or with a Sunbiz e-File account. The paperwork can be filed anytime after January 1st but must be received before the due date of May 1st to avoid a $400 late fee.

Additional Resources

- Florida Department of State – Division of Corporations

- Internal Revenue Service – Employer ID Numbers