Laws

LLC Statutes – California Revised Limited Liability Company Act (§ 17701.01 – 17713.13)

Operating Agreements – § 17701.07, 17701.10 – 17701.12

Definitions – “Operating Agreement” means the agreement, whether or not referred to as an operating agreement and whether oral, in a record, implied, or in any combination thereof, of all the members of a limited liability company, including a sole member, concerning the matters described in subdivision (a) of Section § 17701.10. The term “operating agreement” may include, without more, an agreement of all members to organize a limited liability company pursuant to this title. An operating agreement of a limited liability company having only one member shall not be unenforceable by reason of there being only one person who is a party to the operating agreement. The term includes the agreement as amended or restated.(§ 17701.02(s)).

Formation – § 17702.01 – 17702.10

By Type (2)

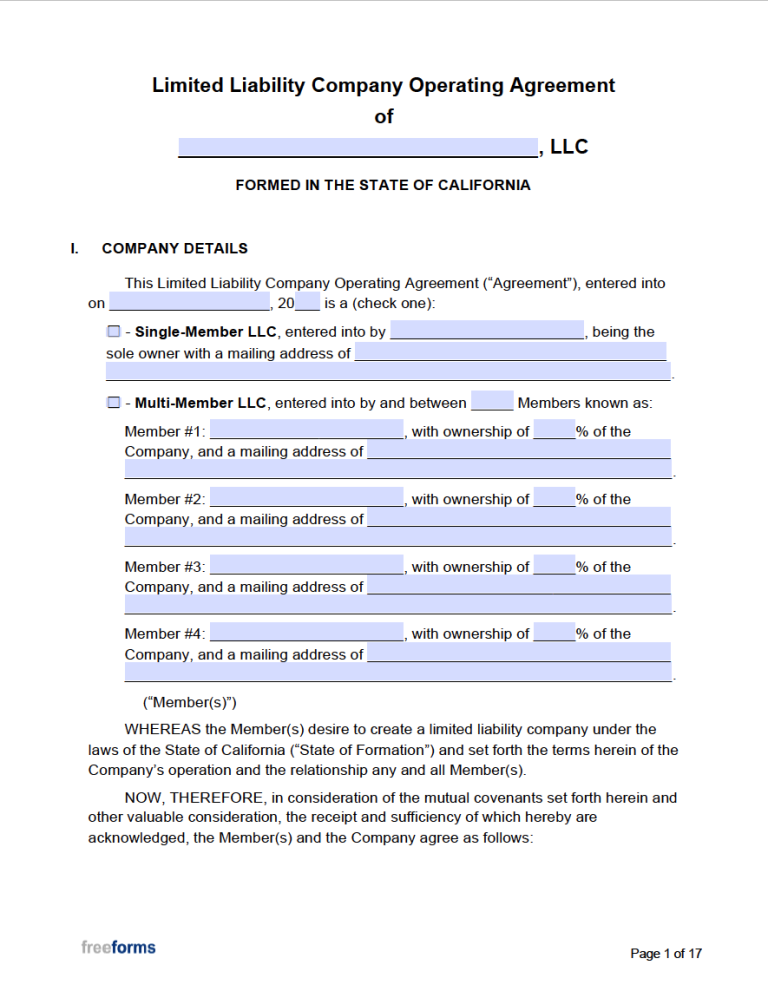

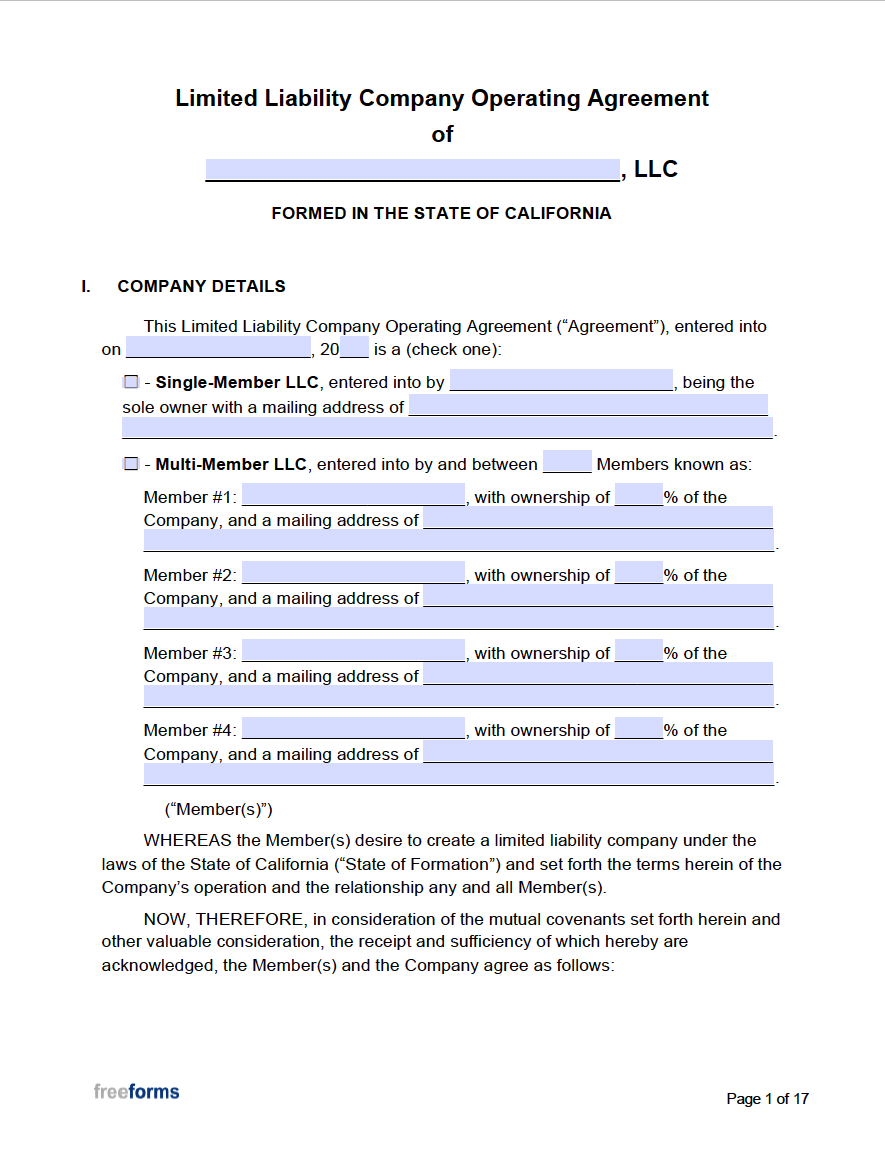

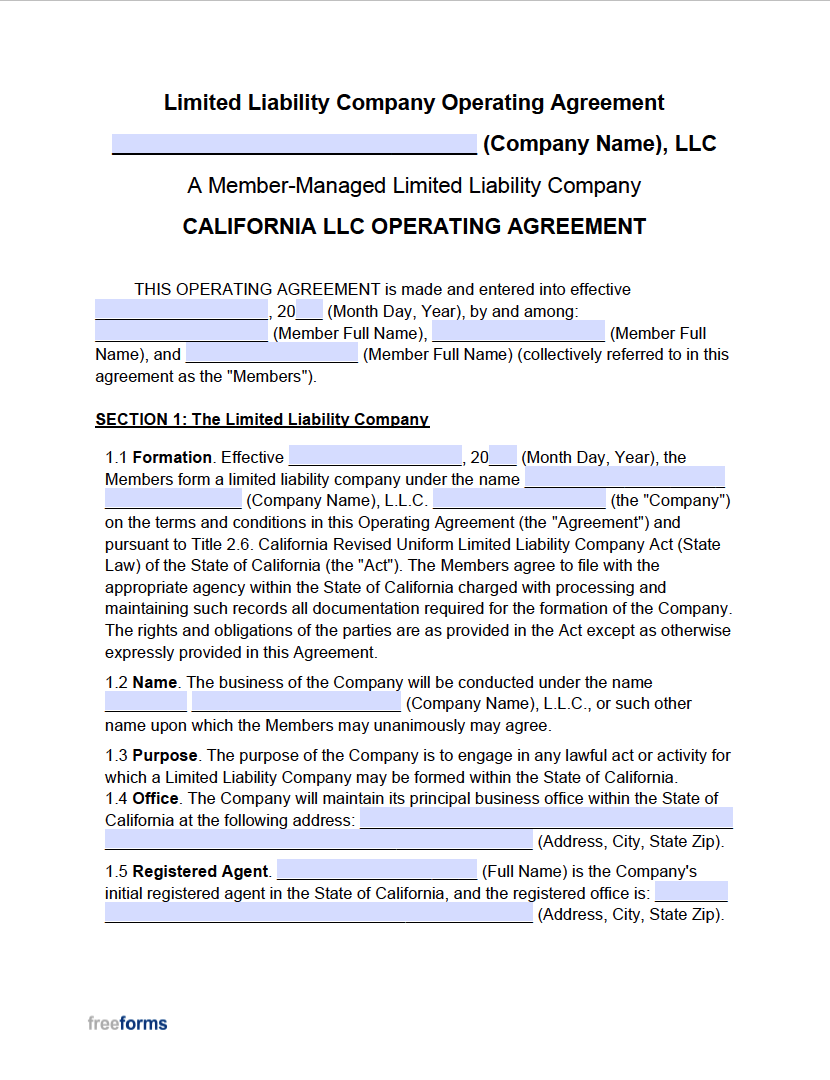

Multi-Member LLC Operating Agreement – Articulates specifics related to how an LLC comprised of multiple members intends to run.

Multi-Member LLC Operating Agreement – Articulates specifics related to how an LLC comprised of multiple members intends to run.

Download: Adobe PDF, MS Word (.docx)

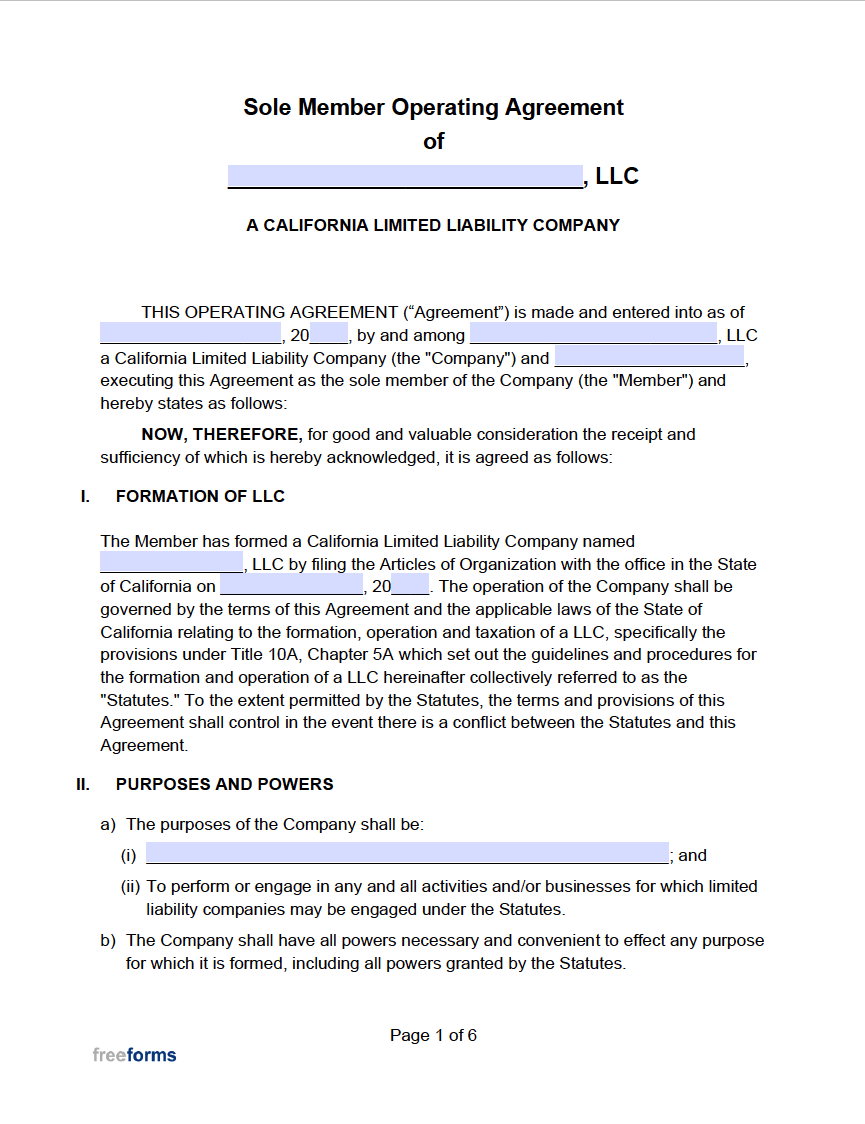

Single-Member LLC Operating Agreement – A legal instrument created to outline the particulars of company operations when a sole individual manages an LLC.

Single-Member LLC Operating Agreement – A legal instrument created to outline the particulars of company operations when a sole individual manages an LLC.

Download: Adobe PDF, MS Word (.docx)

Create an LLC in California (5 Steps)

In order to do business within California, you must first register a business as needed with the state and local governments. Instating LLC status for your company can be accomplished by following the procedure below.

- Step 1 – Reserve a Name for the Business

- Step 2 – Nominate a Registered Agent

- Step 3 – File Articles of Organization with the State

- Step 4 – Execute an Operating Agreement

- Step 5 – Complete Other Necessary Performances for the LLC

Step 1 – Reserve a Name for the Business

When setting up a new LLC, businesses can elect to secure a name prior to filing articles of organization with the California Secretary of State. Name reservations allow for a desired name to be guaranteed for use for a sixty (60) day period up until official formation paperwork is received and accepted. Using the SOS’s Business Search page, run a search to find out whether or not the name you wish to reserve is currently in use. When choosing a name, it is important to make sure that the name complies with the state legislature (set forth in § 17701.08). Business name reservation filings can be submitted online, by mail, or in person:

- Online – To make the request online, you will need to make a user account with Bizfile Online. Select the link and continue as indicated to create an account and apply for the name reservation.

-

- Fees: Payment of $10 can be issued upon submission using a credit or debit card.

- Mail/Fax – To mail or deliver the form in person you can download the Name Reservation Request Form and fill in the desired information as instructed. You can either send or bring the paperwork to one of the following addresses to file with the state:

By Mail:

Secretary of State Business Programs Division

Business Entities

P.O. Box 994260

Sacramento, CA 94244-2600

OR

In-Person:

Sacramento Office:

Secretary of State Business Programs Division

Business Entities

1500 11th St., 3rd Floor

Sacramento, CA 95814

Los Angeles Regional Office:

Secretary of State Business Programs Division

Business Entities

300 South Spring St., Room 12513

Los Angeles, CA 90013

-

- Fees: All requests will necessitate payment of $10 per name. An additional $10 handling fee will be required for in-person submissions.

Step 2 – Nominate a Registered Agent

Official formation for an LLC will require that an individual or entity be designated to receive any legal notices on behalf of the business. An appointed registered agent can be a designated person or a commercial company specializing in agency services. An assigned registered agent does not need to be affiliated with the company as a member or manager, although it is permitted. Registered agents must reside in California with a valid physical address to accept all communications for the company.

Step 3 – File Articles of Organization with the State

To gain formal status as a limited liability company in California, a company has to first file with the state. The filing can be handed in whether electronically using California’s Secretary of State’s website or by sending through the mail for acceptance:

- Online – Applying online is easy and effective, resulting in a quicker processing time for your LLC. Whether filing for a domestic LLC or foreign registration, CA SOS Bizfile Online can be utilized to complete the online form. Select the button labeled “Register a Business“. From there, you can select the appropriate form and click “File Online“. Online submission will require an active site account to complete the application, so if you have not set one up yet, you can sign up using Bizfile before continuing.

-

- Fees: There are no fees for both Domestic and Foreign LLC submissions. The recently passed bill, referred to as the California Budget Act, essentially waives all registration fees for LLCs through July 1, 2023. Optional certification of the articles of organization can be processed for an extra payment of $5.

- Mail/In-Person – Businesses that wish to apply by mailing or attending an office with the document in hand can do so by first downloading the applicable form:

Follow the instructions within the paperwork to compile the required information about the company. Once completed, the document can be printed and sent or hand-delivered to one of the following locations:

By Mail:

Secretary of State Business Programs Division

Business Entities

P.O. Box 994260

Sacramento, CA 94244-2600

OR

In-Person:

Sacramento Office:

Secretary of State Business Programs Division

Business Entities

1500 11th St., 3rd Floor

Sacramento, CA 95814

Los Angeles Regional Office:

Secretary of State Business Programs Division

Business Entities

300 South Spring St., Room 12513

Los Angeles, CA 90013

-

- Fees: There is no fee to register an LLC in California, but for in-person submissions, there is an additional $15 handling fee for each transaction. Certification of the filing can be issued at the request of the business for a supplemental $5 fee.

Step 4 – Execute an Operating Agreement

California Statutes mandate that all LLCs file an operating agreement to ensure a valid understanding of how company operations will be performed upon the official formation. The document’s content covers specific member responsibilities, rights, ownership, and distributions. Select the appropriate form to be used based on the number of interest-holding members associated with the business:

Step 5 – Complete Other Necessary Performances for the LLC

Once the LLC receives documentation of successful application for organization within the state, a number of additional tasks must be carried out. Review the listed requirements and make sure to keep your LLC up to date with municipal and state obligations.

- Obtain a Federal Employer Identification Number (FEIN/EIN)

It is highly suggested (and in most cases necessary) to obtain an EIN from the Internal Revenue Service (IRS) for tax purposes. The IRS provides this registered number to refer to the business concerning its federal tax account. The provided number may also be needed should the LLC need to pay employees, open business bank accounts, or apply for financing.

Applying for an EIN can be conducted by using the IRS website, selecting the link labeled “Apply Online Now,” and continuing to follow the prompted instruction for submission. Companies that prefer to mail in the form can download the Application for Employer Identification Number (Form SS-4) for completion and mail it to the associated address found within the IRS chart of addresses and phone numbers.

- Register Initial and Biannual Statements of Information

After the initial registration of an LLC, the California SOS demands that a Statement of Information be filed within the first ninety (90) days of the formation date. It also must be updated by filing the same form every two (2) years for submission to the state. The purpose of the document is to update any changes to the company regarding contact and management information. It can be filed online by clicking on the link for “File a Statement of Information” and following the prompts.

The filing can also be submitted by mail or in person by first downloading and completing the Statement of Information (Form LLC-12). The paperwork can then either be mailed or hand-delivered to the California Secretary of State at the following addresses:

By Mail:

Secretary of State

Name Availability Unit

P.O. Box 994260

Sacramento, CA 94244-2600

OR

In-Person:

Secretary of State Business Programs Division

Business Entities

1500 11th St., 3rd Floor

Sacramento, CA 95814

Additional Resources

- California Secretary of State – Filing Tips

- Internal Revenue Service – Employer ID Numbers